During peak registration periods, students at Greenville Technical College, Greenville, South Carolina, sometimes waited more than four hours to speak with a counselor about financial aid assistance. A student would sign in to see an officer; and, when called, would enter an office—only to disappear from view. Others waiting in line had no idea when they would be called; how many staff people were on hand to help them; or how long they might have to stand because of insufficient seating.

When I arrived on campus in October 2012 to head up finance and administration, I found angry, frustrated students; weary staff; and very low customer satisfaction. The college had tried to improve service, but the efforts—predominantly focused on changing student behavior—were unsuccessful. It was apparent that we needed an organized, streamlined process.

Searching for a Solution

One suggestion was to investigate a queue management system, in which students sign in online and can then view on a monitor their estimated wait time. By May 1, 2013, we had assembled a design team, including the assistant dean of financial aid, four financial aid officers, and a part-time project manager. Together they examined several commercial options as well as a homegrown system.

After weighing the pros and cons of each option, the team recommended purchasing a system called QLess, based on several factors, including:

- The fastest start-up time of the reviewed systems.

- No requirement to buy equipment.

- Minimal assistance needed from IT.

- Low total cost.

- Immediate benefits.

- Scalability, allowing for additional locations, service queues, and departments.

Steps to Better Service

The design team worked with student services to analyze data and other factors relevant to implementation of the queue management system.

- Clarify the status quo. We created an “as-is” flowchart that outlined the current—although faulty—method for meeting with students. The diagram showed the process, from start to finish, that a student had to follow in order to have his or her questions addressed.

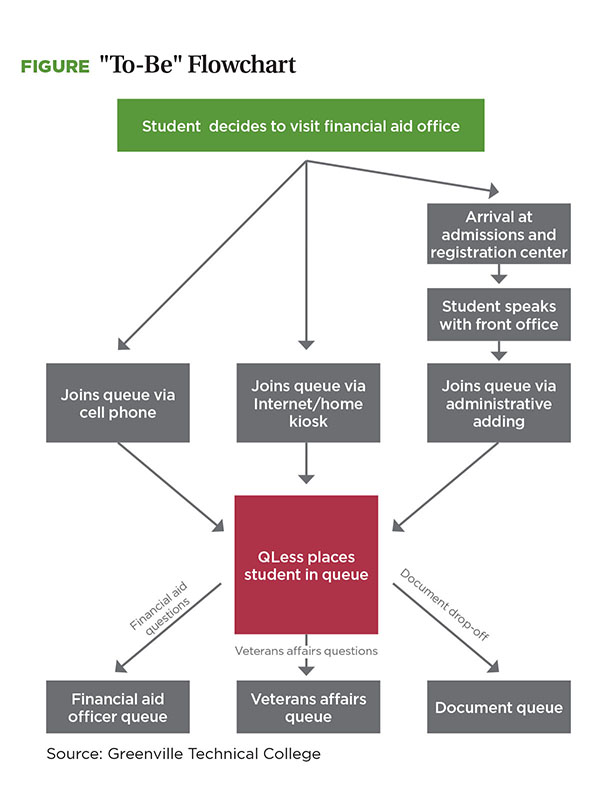

- Consider the ultimate goal. The next step was to design a “to-be” flowchart (see the figure for the first steps in the process) that outlined the optimal process; removed redundant, unnecessary steps; and funneled students to the appropriate person to fill the student’s need.

- Present the ideas. In all-staff meetings, we explained the proposals. Responses were mixed, with some people generally resistant to change; others skeptical that wait time could be accurately estimated or that all students would have access to text messages; and still others genuinely excited about and supportive of the idea.

- Develop policies and procedures. We had to make some design decisions, such as determining the number of queues needed, and to create a set of policies governing the use and ownership of each queue.

Fast Forward

The team rapidly completed the research and the process flowcharts by the time the purchase order was secured on May 22, 2013. At a cost of less than $10,000, the QLess system was operational on May 29, 2013, and the first students were logged into queue that day. The soft launch allowed students to get acquainted with the new system, and provided time to train staff and gather feedback (which was generally positive) before the fall semester.

During that first week, students realized that the increased efficiency freed up time to spend on other activities—with the system keeping students and staff informed in the following ways:

- Sends the student a text message with an initial assessment of the wait time.

- Provides a follow-up message noting that the estimated wait time is coming up soon.

- Allows the student to request more time.

- Provides student services staff with real-time status updates on waiting times, allowing managers to quickly adjust resource levels as required.

- Supplies data to the vendor, which can then provide reports on wait time, student time spent with officers, number of students abandoning the line, and other information managers can use to further streamline the process.

Because of the new transparency of wait times, students can log in to the system from home, and then estimate the time needed to drive to campus for their appointments. Similarly, if they sign up on campus, they can leave to take care of other things, and then return to student services—or even reschedule if they are running late.

Adjustments and Additions

During the implementation, we saw the need for better and faster internal communication, so we added a messaging system to the existing phone arrangement. This allows agents to communicate with other staff members without having to leave their offices or make phone calls. It can also be used to see when staff are busy, on the phone, or in a meeting.

To build awareness of the queue management system, the design team worked with marketing professionals to create an advertising campaign, which we fully implemented in July. One element was a sticker that we placed on department windows and doors—and also posted to our Web site.

Signs of Satisfaction

Students’ positive response has been the greatest benefit. They love the texting system, as reflected in the comments they text back:

“I love the text setup you have. And your staff is wonderful!”

“No waiting time. My experience was very positive and helpful. Thank you.”

We even received a Tweet, saying “This whole text-your-phone thing at Greenville Tech financial aid is pretty sweet.”

We’ve also seen a dramatic improvement in performance of some of our personnel. With daily reports showing the number of students each staff member serves, we can determine the individual efficiency. Everyone is accountable; employees see their performance compared to that of others; and they work to improve. Overall,

the office has increased by more than 43 percent the volume of students seen during the July through August peak season, as compared to the previous year.

A small investment has helped us better manage a large volume of students, while providing much better reporting capabilities. The benefits are so significant that other departments are implementing the system for their own purposes.

SUBMITTED BY Jacqui DiMaggio, vice president for finance, Greenville Technical College, Greenville, South Carolina