Butte College, part of the Butte-Glenn Community College District in northern California, produces approx-imately 90 percent of its annual electrical needs by absorbing the power of the sun. Since 2005, the college, with approximately 11,000 FTE students, has installed 25,000 photovoltaic panels with a combined generating capacity of 4.5 megawatts. The total cost of $33.8 million for the three phases of the solar installation will be more than offset by anticipated savings of $130 million over 30 years.

From the outset, the concept for financing the solar projects has been to actively seek funding opportunities through grants, rebates and incentives, and low-interest loans, and then augment these with district general funds and reserves, says Kenneth Albright, Butte’s director of facilities planning and management.

Multiple Funding Sources

Each phase included a different financing strategy.

- Phase I, a 1.1 megawatt ground-mounted system, came online in 2005. The total cost for this phase was $7.4 million, with 50 percent provided by Pacific Gas and Electric Company (PG&E) California Solar Initiative rebates. The remaining $3.7 million was financed by a loan that will be retired in FY22. In order to get the best interest rate for financing Phase I, the college relied on lease revenue bonds, in which energy cost savings are used to satisfy the debt obligation.

- Phase II, which became operational in 2009, added .75 megawatts of solar generation capacity. This phase included a roof-mounted system and a shaded parking lot structure. The total cost of $9.4 million was financed using a combination of PG&E rebates ($1.76 million), a district contribution from a local education construction bond ($3.75 million), and bank financing ($3.9 million). The financed portion will be retired in FY29.

- Phase III, which became fully functional in 2012, is the largest installation, providing 2.7 megawatts of solar capacity. This phase included shaded parking, covered walkways, and a shaded bus terminal. The total cost was $17 million, covered by $1 million in PG&E rebates, $3.4 million from district reserves, and $12.6 million from Clean Renewable Energy Bonds. The bonds will be retired in FY27.

Steady Payback

In all but one instance, the solar production facilities have performed better than expected. Phase I was installed using technology available at the time, but not fully mature. Some of the equipment experienced early failure and has been replaced, notes Albright. “It is likely that this phase will continue to need more maintenance and repair than the subsequent installations, which incorporated more advanced technology.” Despite the early setbacks for Phase I, it is now producing above expectations. Meanwhile, Phases II and III have been and are consistently producing above expectations, says Albright.

Because the solar arrays produce at their highest levels during the times of peak rates, the cost of purchased electricity is greatly minimized, explains Albright. Based on projections for future electric rate increases and fluctuations in overall consumption, the college anticipates that the solar installations will begin paying off in dramatic ways between 2025 and 2030 as the various loans are retired. At that point the panels should still have significant useful life remaining to continue to provide electricity and savings to the district, notes Albright.

Grid Neutrality and Beyond

While there remains the possibility with existing and future solar installations to overproduce and to become a net producer of solar electric power, the feasibility of this strategy will depend to a large extent on the adoption of regulatory changes that would enable the college to be a net energy generator, says Albright. “One complication to achieving grid neutrality is the existing legal structure with respect to net metering, which looks at individual meters and determines on an annual basis whether the meter is overproducing or underproducing.”

Currently the district’sphotovoltaic arrays areconnected to the grid via 17 separate meters. While some meters produce more electricity than is used, others produce less than is used, and the net metering statute will not allow the district to transfer credit from one meter to another, despite several attempts to change that situation in the legislature, notes Albright.

SUBMITTED BY Karla Hignite, Ogden, Utah, contributing editor for Business Officer.

The 2005 Energy Policy Act established a tax deduction for energy-efficient commercial buildings. In 2008, recognizing governments could not avail themselves of a tax deduction—but still wanting them to use the most efficient systems yielding long-term operating savings—Congress permitted government building owners (including public institutions of higher education) to allocate the 179D deduction to one or more persons “primarily responsible for designing the property.” This can include architects, engineers, contractors, environmental consultants, or energy services providers.

Scheduled to expire at the end of 2013, the deduction was designed to reward the extra effort involved in creating an energy-efficient structure; many higher education facilities are being built to such standards. The maximum permitted deduction can amount to $1.80 per square foot for qualifying new construction and building retrofits.

Benefiting From the Deadline Extension

The law was scheduled to expire at the end of 2013, and government relations efforts (including those of NACUBO) resulted in a revised deadline of Dec. 31, 2014. NACUBO staff and partners also worked to add the term “nonprofit” to the two-year extension, but that did not occur. Ongoing efforts seek to further extend the credit as well as the “nonprofit” language, in order to broaden the deduction’s use for colleges and universities.

Success at the end of 2013 did include agreement from Congress to extend tax deduction allocation until the end of 2014, thus allowing opportunity for considering, retroactively, projects completed from 2011 through 2013.

A number of public campuses, considered as “government institutions” under the tax rules, have taken advantage of the deduction. Some have used third-party consultants to complete and verify the paper work, while other campuses have directly implemented the cost savings.

For example, the University of South Florida (USF), Tampa, has secured more than $135,000 of savings related to a number of different projects. With the assistance of a third-party consultant, Efficiency Energy LLC, the university took advantage of the latest extension (retroactive for projects underway at the end of 2014). The institution applied for and received three different building rebates for the new construction projects at the USF School of Music, the Interdisciplinary Sciences Building, and the Center for Advanced Medical Learning and Simulation.

Ray Gonzalez, assistant director, facilities planning, at the University of South Florida, comments: “This is a win-win for the campus. We gain an energy-efficient project that helps our long-term sustainability commitments, as well as a rebate for the initial work. The rebate funds are then applied back into the building for additional energy efficiency enhancements.”

Renovations and Infrastructure Included

The 179D statute also applied to renovation and infrastructure projects that improved the energy efficiency of a campus. The University of Texas at Austin, for instance, developed a centralized chilled water system to supply cooling to 17 million square feet of its main campus. The project called for construction of a four-million-gallon thermal energy storage system, which included the development of a chilled water loop running through more than six miles of tunnels to reach approximately 150 campus buildings.

With the latest statute extension, the university recently applied for—and is anticipating receiving—a rebate totaling $2.7 million, of which UT Austin will receive more than $1.3 million, and the system designer will receive an equal share. Juan Ontiveros, associate vice president, utilities and energy management, says, “We are excited that the university will be receiving this rebate on this very successful project. We hope to use the funds to create a green revolving fund to finance additional energy conservation projects in campus facilities.”

RESOURCE LINK To read more about green revolving funds, see the feature “Pay It Onward.”

SUBMITTED BY Sally Grans-Korsh, director, facilities management and environmental policy, NACUBO.

“Because of its early commitment to unmanned systems, Indiana State is in a position to help influence national standards,” said Jeffrey Hauser, executive director, Terre Haute International Airport–Hulman Field … and an adjunct faculty member in the university’s aviation department.

‘We worked last year with the Association of Unmanned Vehicle Systems International, in Washington, D.C., and a couple months later, they had us form a group of all the universities working with unmanned systems, to come up with different disciplines as far as academics, what sort of courses should be taught, as well as safety, and get all the universities to work together.’”

—“Indiana State Leads the Way in Unmanned Systems,” STATE, the magazine of Indiana State University

Fast Fact

Gates Foundation to Focus on College Completion

After spending approximately half a billion dollars on the college completion agenda over the past seven years, the Bill and Melinda Gates Foundation turns attention to four key areas of higher education policy affecting completion outcomes. In a newly released document, “Postsecondary Success Advocacy Priorities,” the foundation’s advocacy is described in terms of the four priorities: data and information, finance and financial aid, college readiness, and innovation and scale.

Presidential Perspective

Inside Higher Ed released is fifth annual Survey of College and University Presidents, in conjunction with researchers from Gallup Education. Based on a total of 647 college and university leaders from public, private, nonprofit, and for-profit institutions, the survey granted anonymity to encourage candor, but answers were then coded by institution type, allowing for analysis of sector differences. Among the key findings: fewer than half of presidents described the state of race relations in American higher education as excellent (1 percent) or good (42 percent), although eight in ten characterize their own campus state of affairs to be excellent (18 percent) and good (63 percent); and most presidents want to be more involved in decisions about faculty hiring and tenure.

![]()

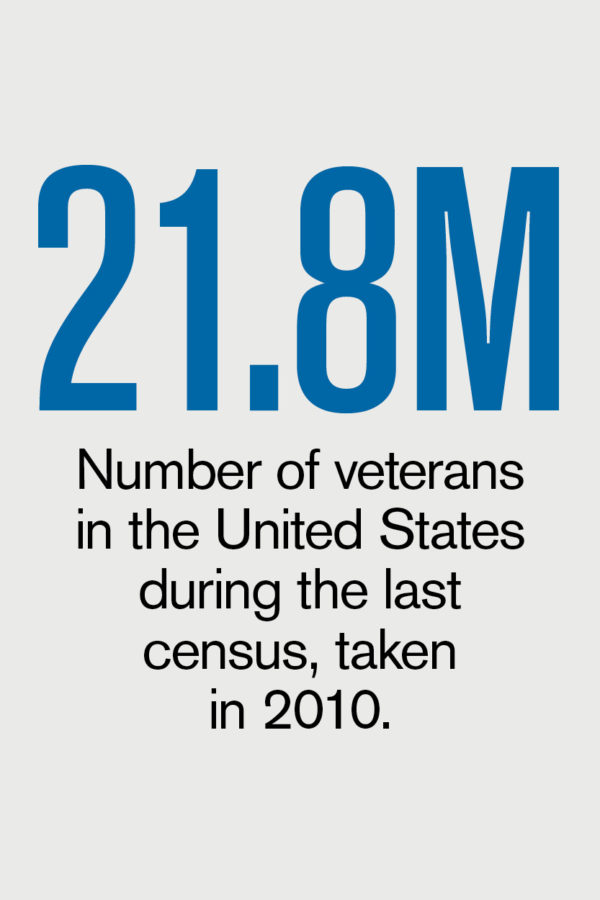

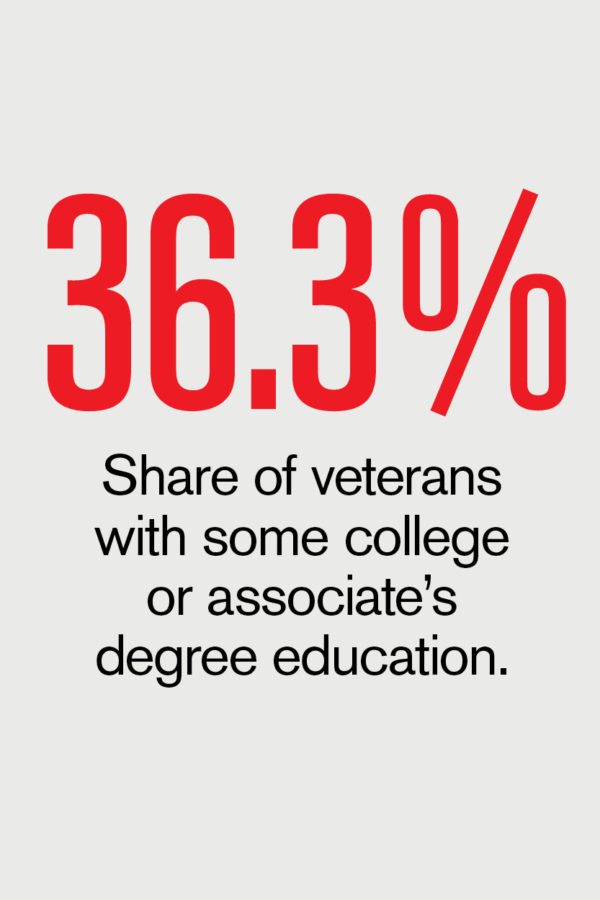

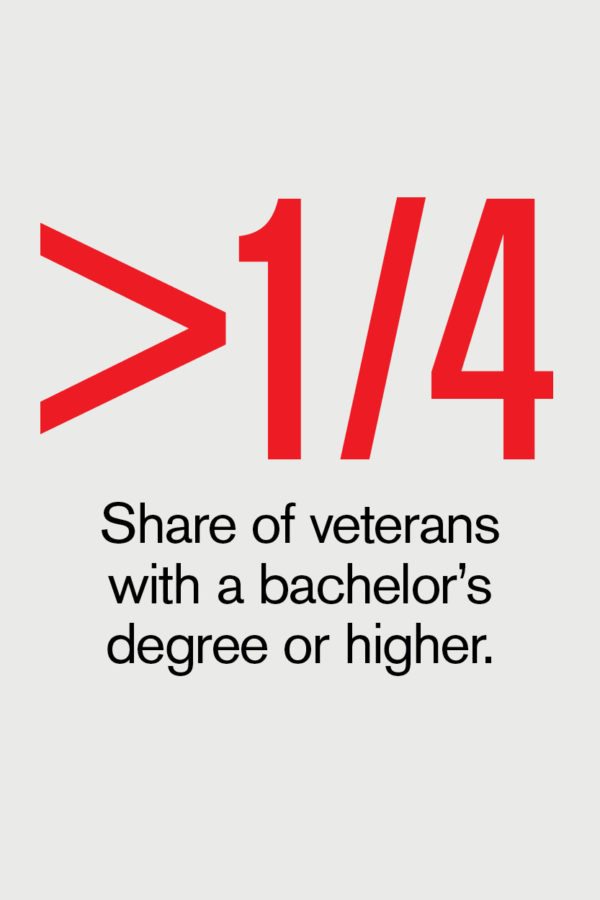

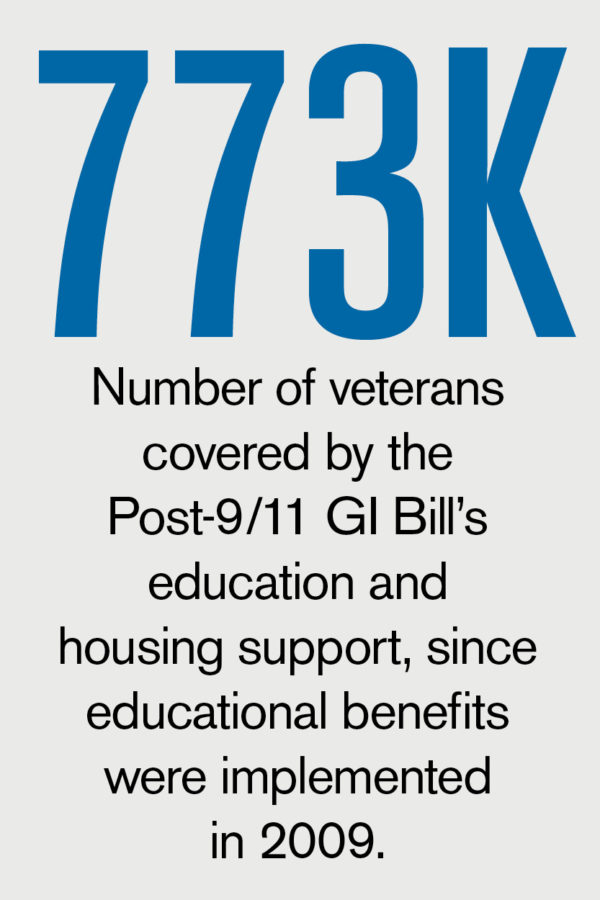

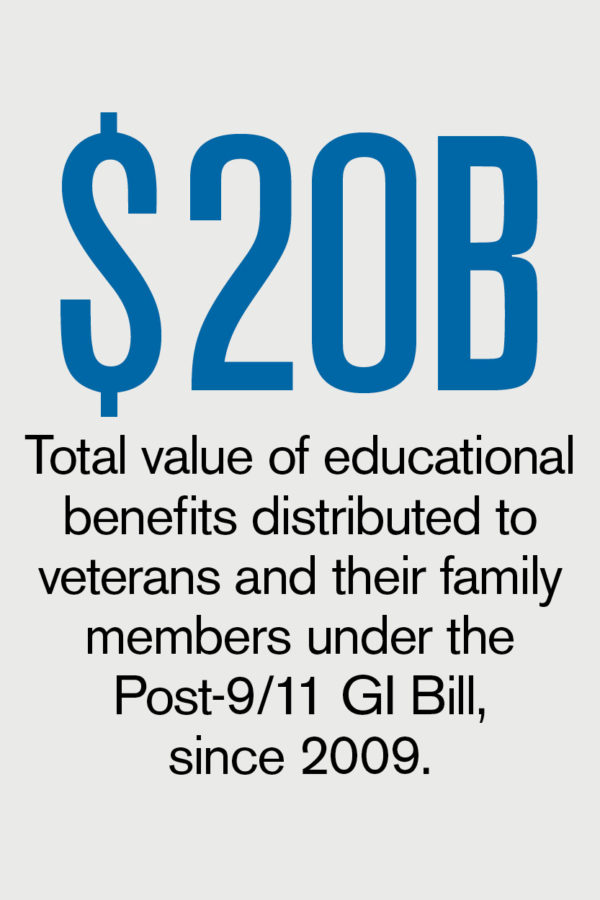

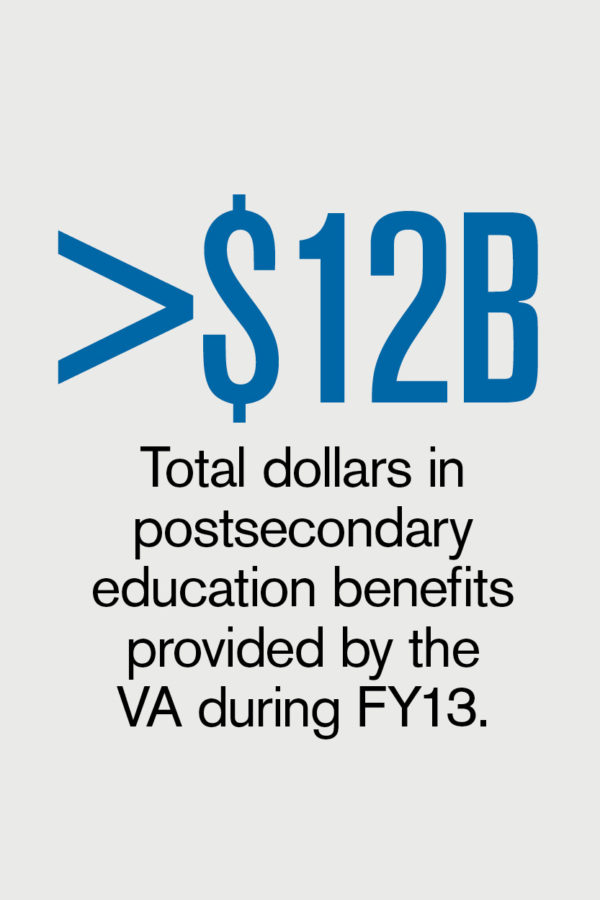

By The Numbers

May: Military Appreciation Month

Sources: Department of Veterans Affairs, U.S. Census Bureau, Hanover Research, and Government Accountability Office