Over the past nine years, investors have benefitted from one of the longest bull markets in U.S. history. From the depths of the Great Recession in 2009 and through the period up to June 2017, actions taken by policymakers around the world have led to lower interest rates, higher job gains, and stronger economic growth. During this stretch, the Standard and Poor’s 500 Index, the broadest measure of American stocks, gained more than 258 percent, according to Yahoo Finance.

FY18 saw these gains accelerate, as stocks were buoyed by a significant boost in federal spending as well as declines in corporate tax rates enacted as part of the Tax Cuts and Jobs Act of 2017. The two-pronged fiscal stimulus helped the U.S. economy achieve gross domestic product (GDP) growth of more than 4 percent during the last quarter of the fiscal year, while unemployment fell below 4 percent—the lowest in nearly 20 years. Under these favorable conditions, it’s not surprising that the S&P 500 gained 14.4 percent between July 1, 2017 and June 30, 2018. College and university endowments were beneficiaries of this strong financial environment, with the average endowment gaining 8.2 percent during the year.

But as the summer of 2018 became fall, these bright financial skies started turning cloudy. Continually rising interest rates, an ongoing trade war with China, the dissipation of the effects of the tax cuts and spending increases, a partial federal government shutdown, and signs of slower economic growth potentially bring trouble for financial markets in FY19. During the September-December quarter of FY19, the S&P 500 lost nearly 14 percent of its value. After being absent for nearly a decade, uncertainty appears to have returned to the capital market.

With these conditions as a backdrop, the following overview of the 2018 NACUBO-TIAA Study of Endowments (NTSE) describes this new research collaboration, recaps the results of the study, and summarizes the many economic and political challenges endowment managers may face in 2019.

A New Research Partnership

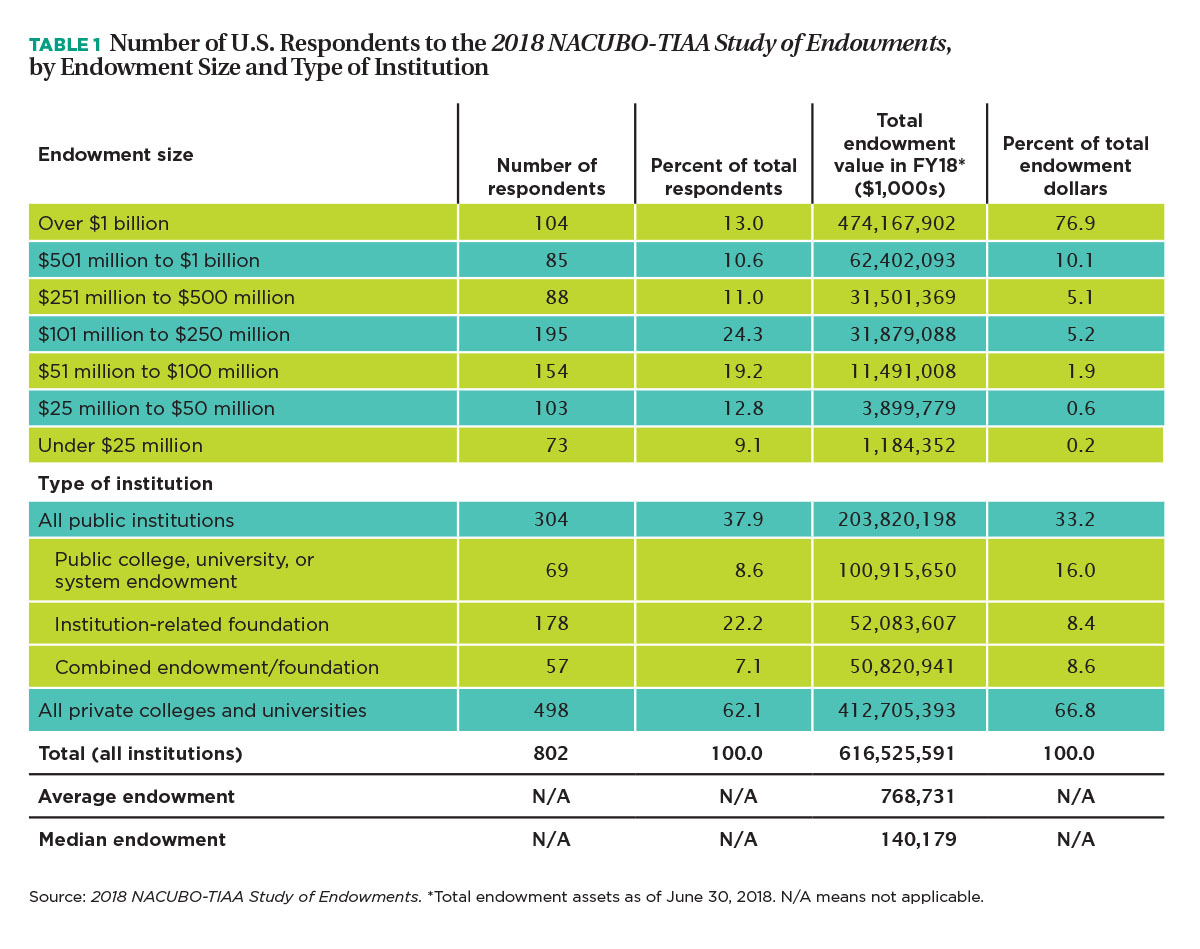

As Table 1 shows, 802 U.S. college and university endowments and affiliated foundations participated in the 2019 NTSE. Collectively, the participating institutions had $616.5 billion in endowment assets as of the end of FY18. While the average endowment among these participants was $768.7 million, the median was $140.2 million. Roughly 9 percent of the participating institutions had endowments less than $25 million. On the other extreme, 104 schools had endowments of more than $1 billion; these highly endowed schools held more than three-quarters of total endowment assets.

These FY18 results are based on the inaugural NACUBO-TIAA Study of Endowments, a landmark research partnership between NACUBO and TIAA. NACUBO and TIAA’s new joint venture ensures and enhances the status of the annual endowment study as the largest, most comprehensive survey of investment management and governance practices at American colleges, universities, and affiliated foundations.

“We are honored to join NACUBO in shaping a dynamic, interactive new endowment study,” says Kevin O’Leary, chief executive officer of TIAA Endowment and Philanthropic Services. “Our new study will continue a tradition NACUBO has maintained for 45 years of delivering high-quality endowment investment performance and governance information for boards, investment committees, and senior financial staff.”

Susan Whealler Johnston, NACUBO’s president and chief executive officer, says, “Our partnership with TIAA guarantees that the endowment study will continue to provide thought leadership from the best minds on endowment management. It will maintain its reputation as the best source of information for colleges and universities to gain new knowledge regarding endowment best practices as institutions continue to use their endowment resources to support their missions.”

Gains Across the Board

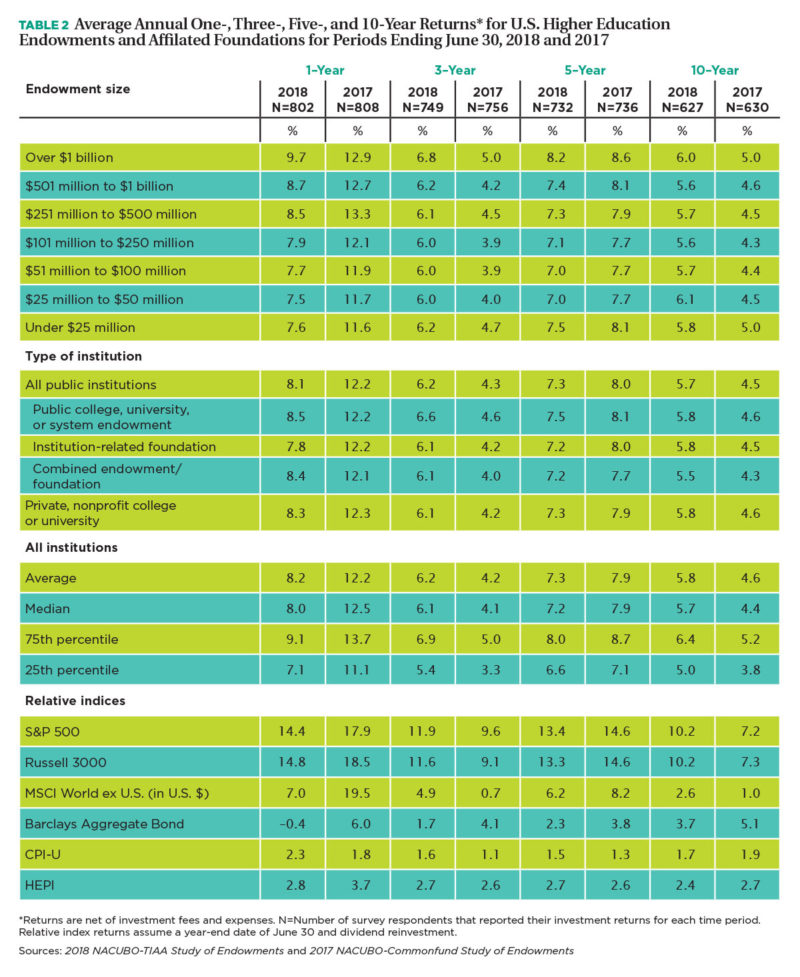

Favorable market conditions helped institutions from all endowment size categories attain positive results. But the largest endowments had a particularly successful year, as Table 2 illustrates. On average, schools with more than $1 billion in total endowment assets saw a 9.7 percent investment gain (net of fees) in FY18, compared with 8.7 percent among endowments valued between $501 million and $1 billion, and 7.6 percent for those with market values below $25 million.

While the FY18 one-year return results are overall very positive, the reported 10-year average return for all participating institutions (5.8 percent) is well below the amount needed to preserve endowment purchasing power after spending distributions. The average long-term return goal of the participating institutions is 7.2 percent, a rate that few schools reached during the past decade. Nonetheless, the largest endowments also outperformed their smaller peers in each of the three-, five-, and 10-year average annual reporting periods.

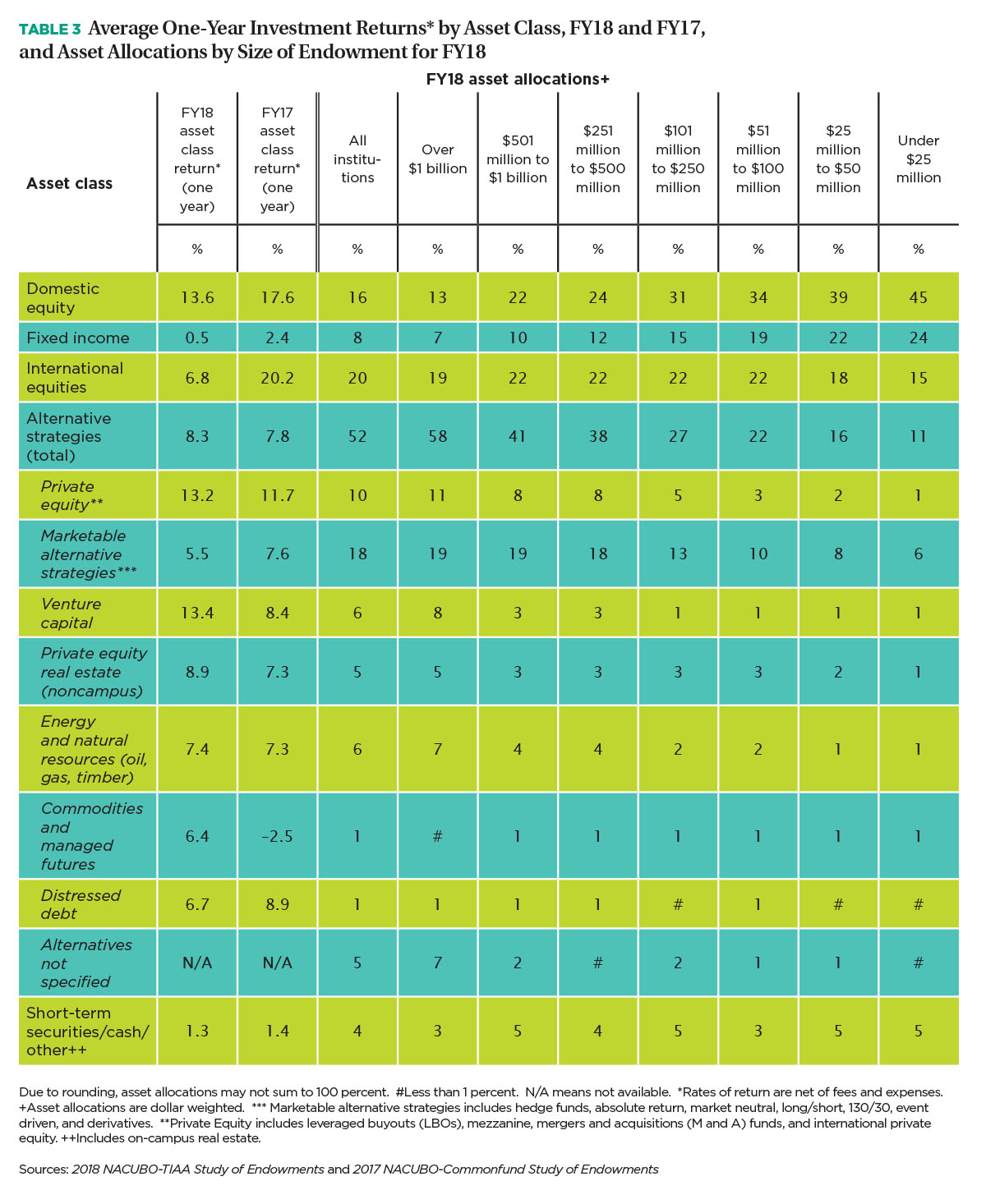

One key reason institutions with the largest endowments posted higher average returns than other institutions is that their investments in several alternative strategies performed higher than average during the year. In 2018, private equity accounted for 11 percent of assets for schools with the largest endowments, and, on average, this investment strategy recorded an average gain of 13.2 percent in FY18 (Table 3). The smallest endowments, in contrast, had just 1 percent of their assets invested in private equity. The largest endowments were also more likely to have investments in venture capital, which returned 13.4 percent during the year, than other endowment size categories.

In FY18, total alternative investments accounted for 58 percent of the endowment assets for institutions with the largest endowments, versus 11 percent of the smallest. Endowments of smaller size were more likely to be invested in U.S. stocks and bonds, which collectively accounted for less than one quarter of the largest endowments’ assets.

Although the returns for FY18 were positive for most asset classes, the average gains for this year were lower than those reported in the FY17 survey. For example, U.S. equities in endowment portfolios returned 17.6 percent in FY17, compared with 13.6 percent in FY18. Returns for non-U.S. equities showed an even steeper decline—from 20.2 percent in FY17 to 6.8 percent in FY18. The average return for fixed income (U.S. and foreign bonds combined) also declined, from 2.4 percent to 0.5 percent.

Spending Dollars Increase

Collectively, NTSE participants withdrew about $21 billion from their endowments to support campus operations (not including amounts spent for investment fees and other expenses for managing endowment assets). On average, endowment withdrawals accounted for about 10 percent of total operating budget revenue for institutional participants. Endowment withdrawals supported nearly 17 percent of the operating budgets for schools with the largest endowments.

These endowment dollars provide a vital source of revenue for institutions to support student scholarships and other financial aid programs, faculty research, maintenance of campus facilities, and other mission-critical functions. Endowment dollars enable institutions to expand or support programs that might not otherwise be funded.

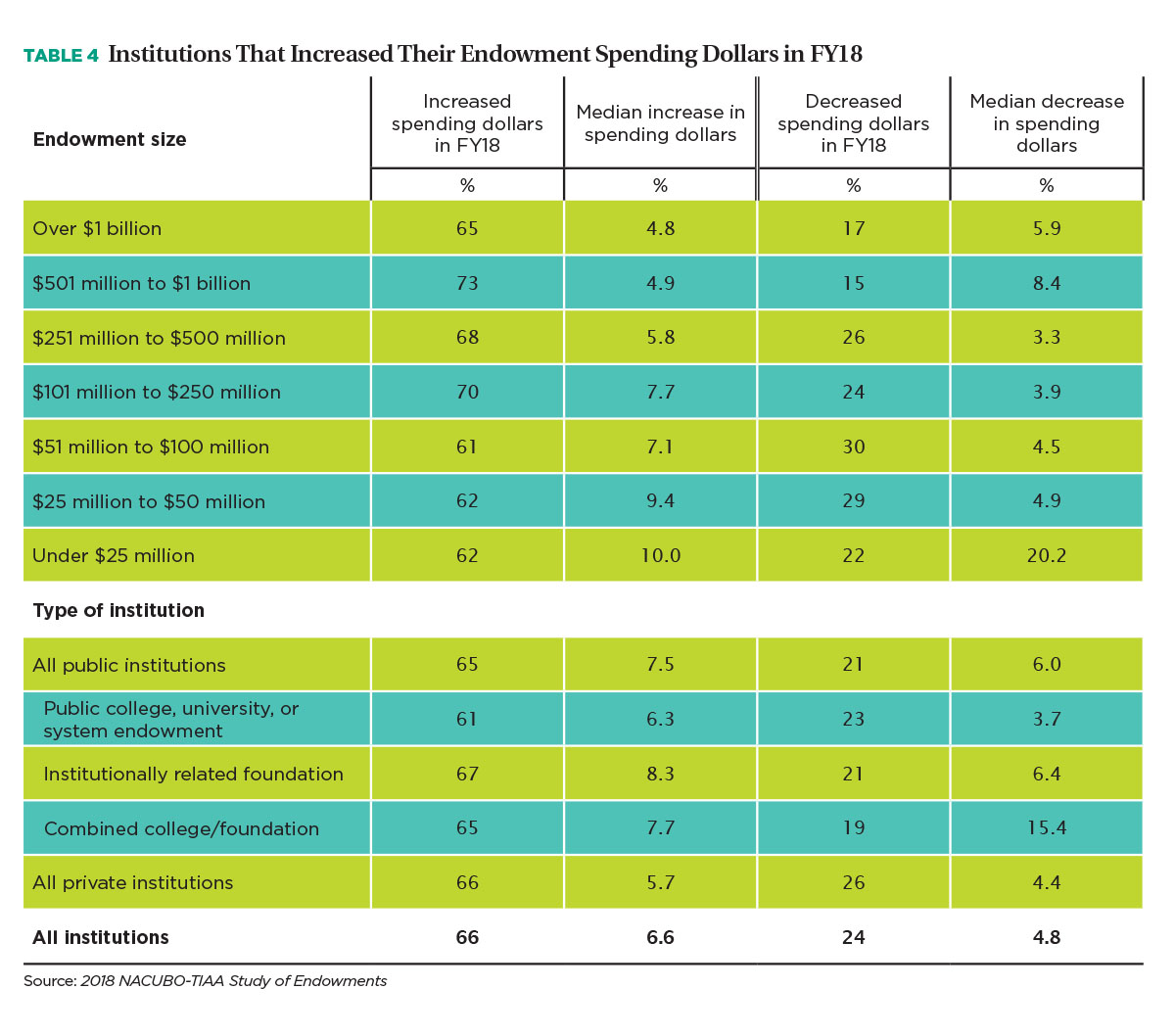

In the short run, the recent rise in investment returns has benefited many of these programs, as institutions reported that they increased the dollars spent from their endowments to support student financial aid and other institutional operations. As Table 4 shows, about two-thirds of NTSE participants said that they increased the amount of funds spent from their endowments to support their campuses in FY18 (not including amounts spent for investment management fees or other expenses for running the endowment). Among those schools that increased their endowment spending, the median increase was 6.6 percent. The smallest endowments generally had higher spending increases than the larger ones, but a much greater share of total endowment funds came from the largest endowments. In contrast, about one-quarter of the survey participants reported a decline in their endowment spending dollars, with a median decrease of 4.8 percent. Generally, schools with smaller endowments were more likely to report reduced spending dollars than larger ones.

Increases in endowment spending dollars suggest that, for the most part, increases in institutional endowment withdrawals were taking place despite the below-target long-term returns that most institutions have faced over the past decade. This spending is a great benefit to students, faculty, and other campus constituencies, as it demonstrates that university leaders are committed to using their endowment resources to support important campus operations in spite of any market gyrations. Increased endowment spending also suggests that schools may be facing financial and other challenges as they rely more heavily on their endowments during a period of potential turmoil in the investing environment.

Increases in endowment spending dollars suggest that, for the most part, increases in institutional endowment withdrawals were taking place despite the below-target long-term returns that most institutions have faced over the past decade. This spending is a great benefit to students, faculty, and other campus constituencies, as it demonstrates that university leaders are committed to using their endowment resources to support important campus operations in spite of any market gyrations. Increased endowment spending also suggests that schools may be facing financial and other challenges as they rely more heavily on their endowments during a period of potential turmoil in the investing environment.

What’s Next?

As FY19 began, it appeared that the accelerated economic growth that began in 2018 would continue throughout the new fiscal year. Near the end of September 2018, the S&P 500 reached a new high for the calendar year of 2,930.75, powered by sustained improvements in the economy, job growth, and corporate earnings.

Beginning in the late fall of 2018, however, the outlook for further investment gains suddenly became murky. For much of the second quarter of the fiscal year, stocks were in a free fall, as investors were spooked by continued raises in the short-term interest rates set by the Federal Reserve; rising tariffs and other risks imposed by America’s trade war with China; and warnings of lower earnings from major technology and other multinational firms. Investors also worried about rising political instability resulting from the prospect of a “no deal” Brexit, the United Kingdom’s vote in a referendum to leave the European Union, as well as from the potential social and other costs of the partial shutdown of the U.S. federal government that began in late December.

As a result, both U.S. and foreign stocks were routed October-December 2018. For the full calendar year of 2018, the S&P 500 fell 6.2 percent, its steepest annual loss since the Great Recession. The first quarter of calendar year 2019 has seen continued volatility and uncertainty as well.

Prospects for continued losses in the financial markets are not the only issue endowment managers need to worry about in today’s climate. Higher education faces myriad challenges, including: declining support from the general public; falling enrollment; pressure on net tuition revenue; reduced state financial support; rising operational costs; increasing unwillingness and inability of families to pay tuition charges; and heightened regulatory oversight. Also, the Tax Cuts and Jobs Act effectively eliminated the charitable deduction for millions of taxpayers, potentially adversely affecting new gifts to all nonprofit organizations, including higher education.

The uncertain future brings many questions about the actions endowment managers can take to help their funds continue to meet their institutions’ short- and long-term goals. These include:

- Should endowment asset allocations take on more risk to meet long-term goals?

- Should long-term investment return targets be lowered?

- How much more can endowment spending dollars be increased if long-term returns continue to fall below institutions’ targets?

The answers to these questions will depend on institutional size and context. Regardless of campuses’ responses, it is critical that college and university leaders keep their focus on the three most vital purposes of endowments: to generate income that benefits students; to ensure long-term growth for future generations; and to support and advance institutional mission.

KENNETH E. REDD is senior director, research and policy analysis, NACUBO.