DOING THE NUMBERS

Best Practices in Tax, Accounting

Sessions in this track surveyed current issues and best practices in the core business office functions of accounting and tax administration.

Stronger Controls Needed

Recently, U.S. News & World Report has removed several institutions from its rankings upon discovering inaccuracies in nonfinancial information they reported. Such nonfinancial irregularities can be perceived as fraudulent, and can damage the reputation of an institution as well as that of its trustees and senior officers. Yet, business officers and audit committees may lack awareness of the broad scope of such reporting.

Nonfinancial data includes such areas as key performance indicators, compensation, institutional amenities, acceptance rates, retention, graduation, standardized test scores, environmental sustainability, and more. Often the controls over gathering and reporting such data are weaker than controls that are in place over financial reporting.

In the session “Protecting the Integrity of Nonfinancial Reporting,” Robin Aspinall, Claremont McKenna College, Claremont, Calif., reviewed a case of poor controls over standardized test data stored by her institution. An internal investigation revealed no cross-checks of database output. Now, data collection and output and report preparation are separate risks in the institution’s enterprise risk management process, and properly credentialed staff pay attention to the preparation and review of certain reports.

David Surgala, Bucknell University, Lewisburg, Pa., reported a similar situation. Bucknell established an internal review team to understand exactly what was discovered concerning standardized test misreporting. Then, the university prepared an extensive communications plan for corrective outreach to the media, ratings agencies, external auditors, and municipal analysts.

Aspinall and Surgala, along with Larry Ladd, Grant Thornton’s director for its national higher education practice, helped attendees identify ways to elevate the profile of nonfinancial information so that it receives proper attention from senior management and trustees. They addressed such tactics as creating an inventory of information requests, regular reporting expectations, and necessary controls, as well as staff awareness and ongoing training.

Dollars Drive Athletics Dialogue

“Out of more than 1,200 schools, only 23 earn more than they spend on athletics,” noted Kathleen McNeely, vice president of administration and chief financial officer of the National Collegiate Athletic Association, in the session “Trends in Athletic Funding.” In a thorough review of the NCAA’s finances, McNeely pointed out that most of the association’s revenues come from one source: men’s basketball championships.

And institutions’ expenses are growing at a higher rate, said McNeely, for several reasons: continuing escalation of coaches’ salaries, an arms race in athletics facilities, a slowing down of football ticket sales, and institutional scholarships that may bump up tuition and fees.

What to do to address the issues? “Do pro formas to test your assumptions that athletics facilities and renovation are worthwhile,” said McNeely. While NCAA subsidies provide millions of dollars for student scholarships, help donor giving, and facilitate networking among alumni, “we still need to set priorities,” McNeely cautioned. (For detailed information on athletics funding trends, see “Finances on the Field,” in the July/August issue of Business Officer.)

PLANNING AND BUDGETING

From Strategy to Action

In these sessions, attendees heard how to incorporate integrated planning, financial modeling, performance measurement, and other innovative strategies into their institutions.

Insights Into Performance Funding

In a session moderated by Lorrie DuPont of RBC Capital Markets, a panel of presenters discussed several aspects of performance funding and how it impacts public institutions. Panelists for the session, titled “The Role of Performance Management in State Funding of Higher Education,” additionally shared what went well at their institutions, as well as what didn’t.

William Zumeta, professor of public affairs and professor of education at the University of Washington, provided a history of performance funding. He acknowledged that while there was a significant decrease in performance funding programs during the recession—with states prioritizing their “core funding”—the number of programs has been steadily on the rise since the recovery began.

Barry McBee, vice chancellor and chief governmental relations officer, University of Texas System, described several challenges that states face in utilizing performance funding, explaining that at its core, the process is complex and often “too much for state legislators to get their arms and minds around.” Add to that the difficulty in assessing diverse institutions within a system that is using “one-size-fits-all” metrics, and one sees why some states have abandoned or failed to adopt performance funding.

It can work, argues Joan King, associate vice president and chief university budget officer, Washington State University, especially if students are interested in entering programs targeted for performance funding, though “student interest in programs waxes and wanes,” noted King. Equally important, however, is having employers interested in employing students after they leave the institution.

Leadership Can Begin With a Small “l”

Sometimes the type of leadership an institution needs is not heroic, but rather an approach that allows others to be leaders in small ways. This was the advice included in the session, “Chief Business Officers Needed: Effective Strategies for Today’s World.”

One of the presenters, Guilbert Brown, assistant vice president for planning and budgeting and chief budget officer, George Mason University, Fairfax, Va., based this conclusion on two change initiatives he’d undertaken—upgrading an antiquated information technology system at Georgetown University, and writing off an insolvent hotel owned by George Mason University.

Commenting on Brown’s case studies about the two change initiatives, copresenter Lynn Oppenheim, president, Center for Applied Research, pointed out: “If you are going to move from strategy to action, your people need to be on board.” At the same time, it’s easy to talk about engagement, but difficult to achieve. “Communication must be authentic,” said Oppenheim, “and we need better ways to gather input from stakeholders.”

To sustain change, suggested Brown, “We found ‘pilots’—people and processes that were already in place—already doing the things that are moving in your intended direction. To change behavior for the long haul,” he concluded, “you either find or create the support for it.”

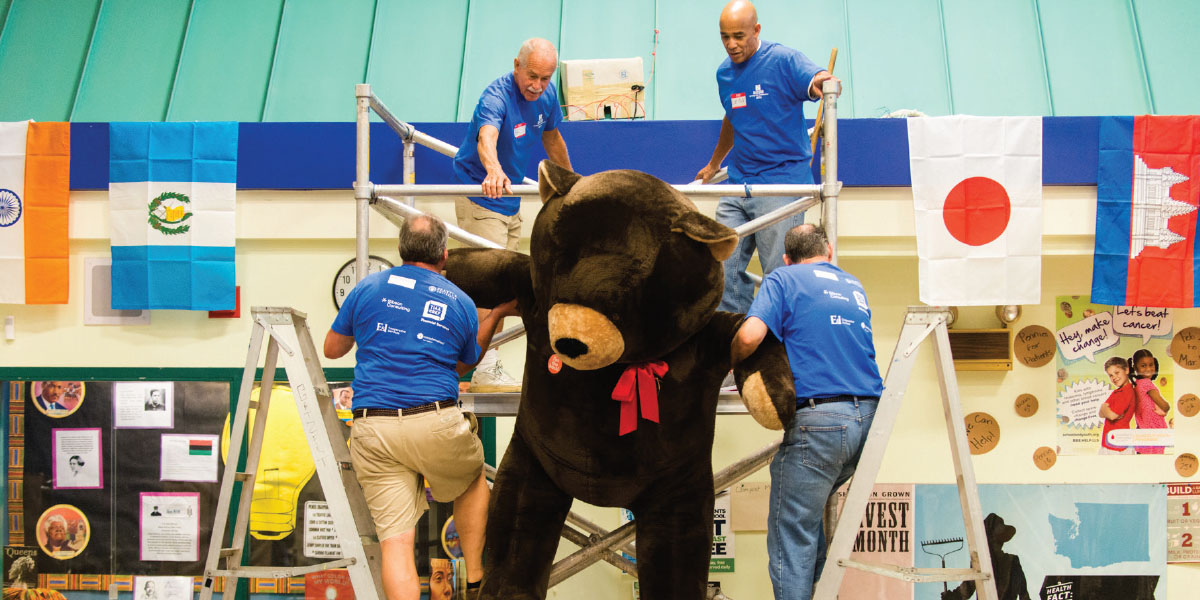

The exhibit hall featured the products and services of 171 companies (231 booths) involved in industries such as accounting, architecture, auxiliary services, facilities management, financial services, student housing, and technology.

The exhibit hall featured the products and services of 171 companies (231 booths) involved in industries such as accounting, architecture, auxiliary services, facilities management, financial services, student housing, and technology.