Fiscal year 1974 was a gloomy time to launch a study of college and university endowment performance. From July 1, 1973, to June 30, 1974, the U.S. economy was mired in deep recession. Inflation-adjusted gross domestic product—a broad measure of economic activity—fell by 2.1 percent, while inflation climbed to 12.3 percent. The fiscal year also saw the second of several “oil shocks”—a series of oil embargoes engineered by the Organization of the Petroleum Exporting Countries, which caused the average price per gallon of gasoline to jump 43 percent. This was the era of the “misery index” (the sum of the nation’s inflation and unemployment rates), which averaged 16 in the middle part of the 1970s. Not surprisingly, in this environment the Standard and Poor’s 500 Index returned roughly –14.5 percent in FY74.

Nonetheless, in 1974, NACUBO undertook its first examination of college and university endowment investment rates of return and asset allocations, and the final report, Results of the 1974 NACUBO Comparative Performance Study and Investment Questionnaire, was published soon thereafter (previous endowment surveys were conducted by Dartmouth College, Hanover, N.H.).

Since the launch of the project, NACUBO’s annual endowment survey series—now called the NACUBO-Commonfund Study of Endowments—has become the largest and most widely used and recognized examination of institutional investment performance. Over the years, the NCSE has demonstrated the key role endowments have played in funding many campus priorities, particularly student financial aid and faculty research. In FY14, endowment income accounted for 9 percent of operating revenue, on average, at higher education institutions. This reliance on endowments has brought with it growing complexity, greater scrutiny, and much more attention to governance and other issues.

To celebrate the 40-year history of the NACUBO study series, Business Officer asked several campus investment officers and other experts to reflect on the various changes in endowment investment strategies and governance that have occurred over the past four decades. Here is an overview of the trends and issues that college and university endowments have faced during the past several decades, and the new challenges that may be on the horizon.

Higher Returns to Support Student Needs

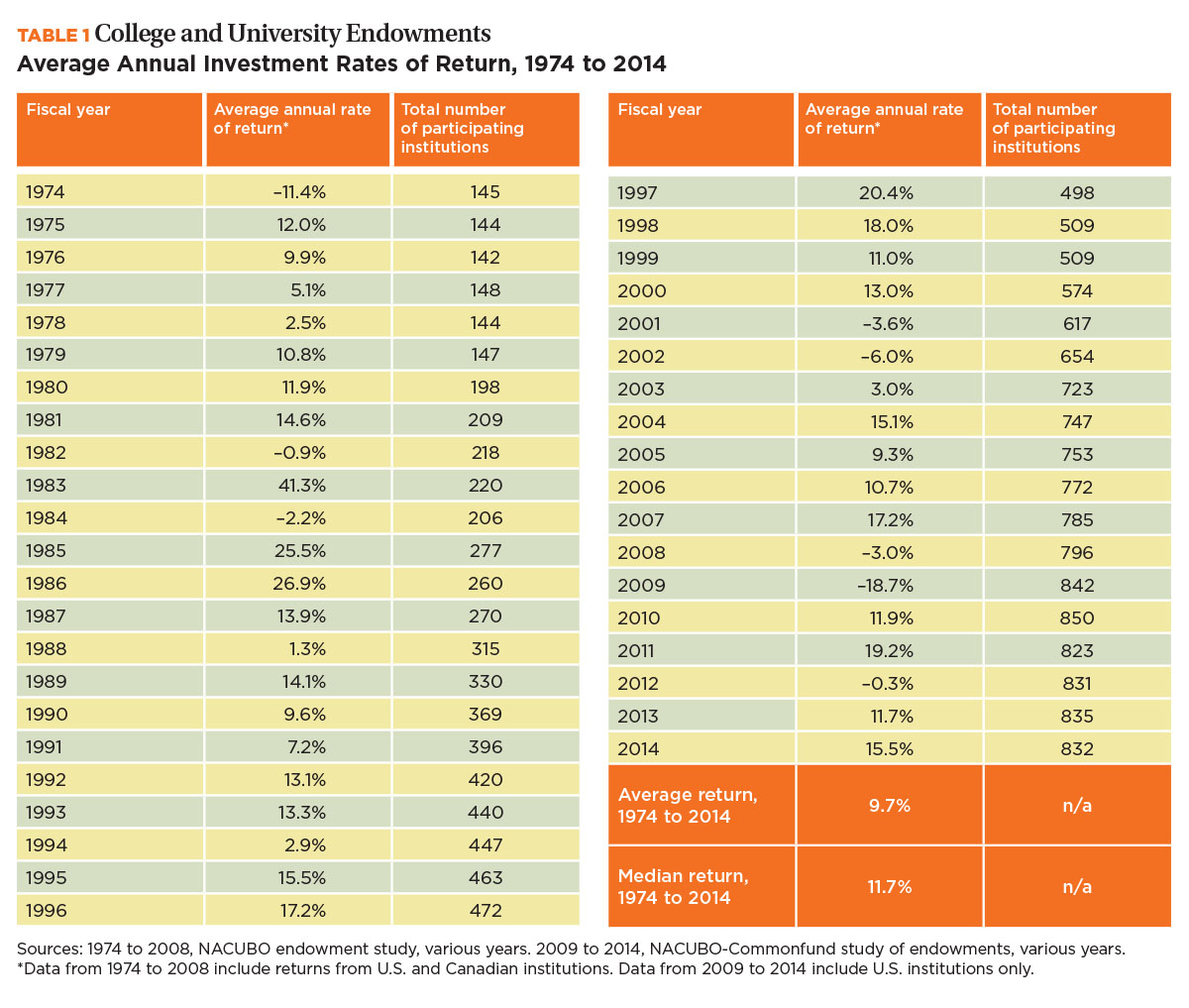

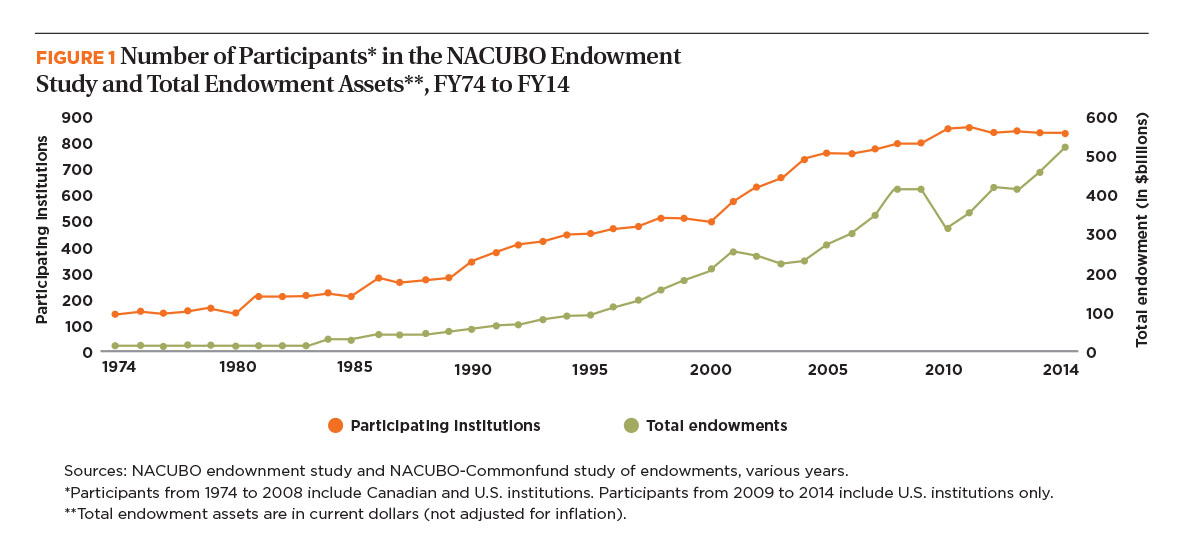

Only 145 schools participated in the first NACUBO endowment survey, and collectively these endowments held $7.5 billion in assets (see Table 1 and Figure 1). Since then, the number of endowment study participants rose steadily. In FY14, 832 institutions took part in the survey project, and these schools had about $516 billion in endowed funds (as of June 30, 2014).

In FY14, the median endowment among participating institutions was $109.8 million (compared with an inflation-adjusted value of $86.7 million in FY74). Students attending schools with both large and small endowments have benefited from this growth. “Our endowment and the continued growth of philanthropy has been an important consideration in meeting our goals of increasing student affordability and accessibility,” says James S. Almond, senior vice president and assistant treasurer, Purdue University, West Lafayette, Ind. Purdue’s total endowment funds reached approximately $2.4 billion in FY14, according to the NCSE. Michelle D. Matis, vice president and chief operating officer for the $78.4 million Valencia Foundation, Orlando, says, “It’s extremely important to our board that students get access to scholarship funds generated by our endowment right when they need it most, when the economy is still struggling.”

Participants in the inaugural NACUBO study reported an average return of –11.4 percent for FY74, then a record low for the endowment series. Fortunately, FY74’s steep loss was not a harbinger of things to come. Over the four decades that NACUBO has conducted an endowment study, annual reported returns (net of fees) averaged 9.7 percent, with a median annual return of 11.7 percent, as Table 1 illustrates. While overall returns have generally been positive over the 40 survey years, there have been many years of volatility. From FY80 to FY89, for instance, annual returns averaged 14.6 percent. But, over the past 10 survey years (FY05 to FY14), annual returns were only 7.3 percent on average. The lowest annual return in the study’s history occurred in FY09, when in the midst of the Great Recession endowments averaged a –18.7 percent performance. The highest return occurred in FY83, when during a sharp economic recovery endowments achieved a 41.3 percent average investment gain.

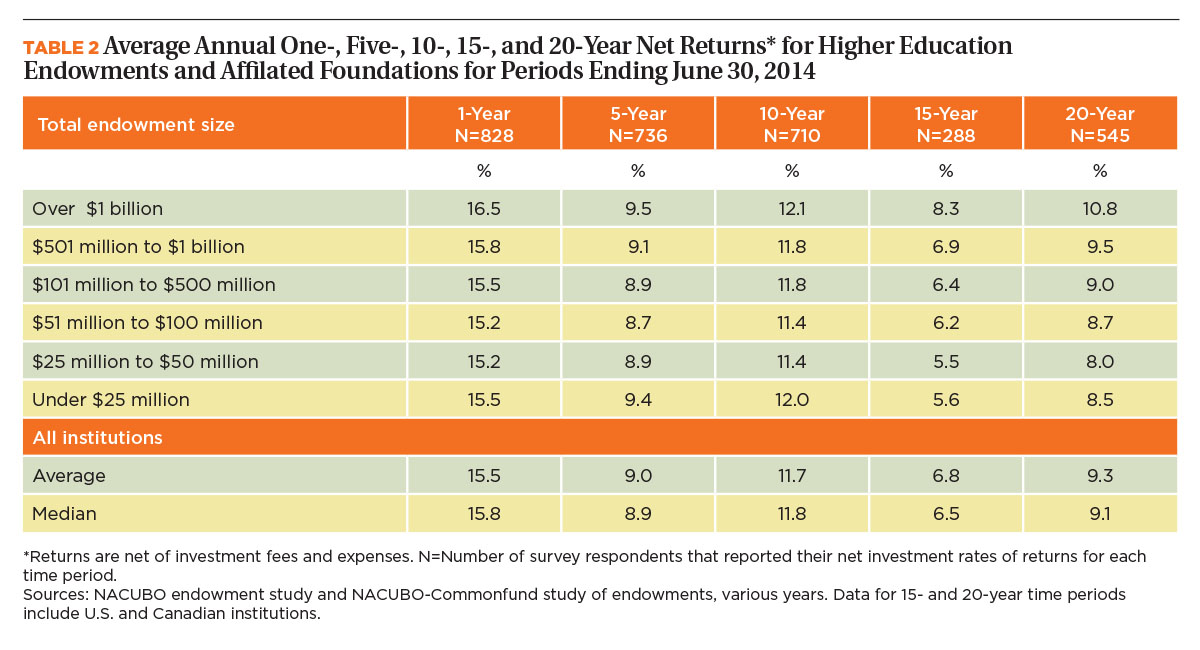

However, these return data are not adjusted for differences in the number of schools that participated in the project over the years, or for differences by endowment size. Table 2 shows that among the 545 institutions that have participated in the survey for 20 consecutive years, the average annual return has varied from 10.8 percent for the schools with endowments over $1 billion to 8 percent for those with endowments ranging from $25 million to $50 million (endowment sizes as of June 30, 2014). The average annual return among all these schools was 9.3 percent and the median was 9.1 percent.

More Complex Portfolios

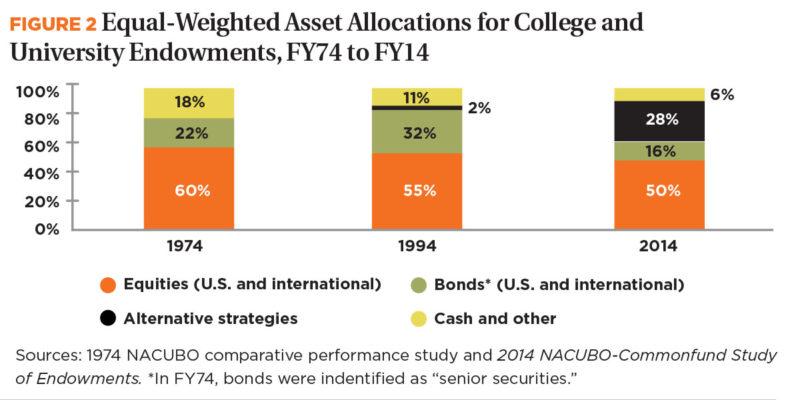

Thomas Heck, chief investment officer of the Ball State University Foundation, Muncie, Ind., (with an endowment totaling $192.2 million) notes that NACUBO’s study has focused investment managers’ attention on changes in asset allocations. “The most significant change in endowments that I have seen is the evolution of asset allocation, influenced significantly by NACUBO’s surveys over the years,” Heck says. “Back in the 1970s and 1980s, institutions were predominantly stock and fixed-income investors. The 2000s, however, saw a significant adoption of the highly diversified ‘endowment model’ that includes more ‘alternatives,’ such as hedge funds, private equity, and other nontraditional investment strategies.”

Asset allocations data from the past and recent studies illustrate Heck’s point. In FY74, the average “equal-weighted” endowment portfolio had less than 1 percent of assets in alternative investment vehicles, compared with 60 percent in domestic and foreign stocks, 22 percent in bonds (U.S. and international), and 18 percent in cash equivalents and other asset types. By FY14, portfolios on average had 28 percent of total assets in alternative strategies, 50 percent in equities, 16 percent in bonds, and just 6 percent in cash (see Figure 2).

Endowments increased their alternative holdings in order to increase their investment returns while minimizing risk. “Endowment investors have learned—and are still learning—about the separation of achieving ‘alpha’ (returns higher than specific benchmarks) while minimizing ‘beta’ (extreme volatility in returns),” says Sally J. Staley, chief investment officer, Case Western Reserve University, Cleveland. Her university’s endowment was valued at $1.8 billion in FY14. “Understanding the difference between these two concepts has become key to portfolio construction, benchmark selection, performance attribution, risk budgeting, and even fee negotiation with external fund managers.”

According to Purdue’s Almond, schools with both large and small endowment sizes have adopted alternative strategies. “Private equity, venture capital, and hedge funds, in particular, have become mainstream,” he says. “Access to higher-quality alternative opportunities is now more common than what may have been available decades ago.”

John S. Griswold, executive director, Commonfund Institute, believes that most institutions have benefited from these alternative strategies. “Over the years, expert investment managers have more successfully employed venture capital, private equity, and hedge fund strategies, as well as investments in real estate, oil and gas, and other commodities.”

Additionally, both Heck and Matis suggest that changes in accounting standards also influenced endowment growth, investment returns, and spending policies. In particular, as Matis points out, has been the adoption of the Uniform Prudent Management of Institutional Funds Act (UPMIFA), which radically influenced the ways in which finance committees can use endowed funds to support students. “UPMIFA enables our boards to view endowment management as a long-term approach,” Matis says. “This includes setting spending policies based on a standard of prudence and not just based on current market value in comparison to the historical value. UPMIFA also gives us a way to modify a restriction on an older endowed fund that had restrictions that are no longer practical. We are now able to disburse these dollars to students using modified restricted criteria, even if the original donor has died, or cannot be found after 20 years.”

More Reliance on Outside Help

The growing use of alternatives in endowments has led to an even greater reliance on outside advice through consultants, advisory firms, and outsourcing of investment functions by campus endowment managers. In FY14, 82 percent of NCSE respondents said that they used consultants to help perform one or more investment functions, and 43 percent said that they have substantially outsourced most or all of their investment functions.

Investment pros at schools with large and small endowments have used consultants to help make better investment decisions. “Purdue has used consultants to provide access and information about new and current investment managers as we have developed our own internal process and systems,” Almond says. Matis adds that “consultants help us set up appropriate asset allocation and give us access to better quality managers that we wouldn’t have access to on our own. The ability to access quality managers has been a key factor in our investment committee’s decision to use a consultant.”

David A. English, chief financial officer and vice president for finance and management, Denison University, Granville, Ohio, believes that “consultants can bring deep expertise to a narrow area, such as looking at the structure of hedge fund investments.” Denison University had a $771.8 million endowment at the end of FY14.

But the high cost of consultants has created a worry for many higher education institutions. “They can be very expensive,” Matis says. “This is especially true if you use a lot of index funds in your asset allocation, as this adds to the overall cost of the services based on asset size without really much extra benefit. And making sure that you are aware of all the fees involved can be challenging.”

Staley points out another potential disadvantage for using consultants: “It is often difficult to find a consultant who is willing to and is able to adapt and customize his firm’s investment practices to a client’s specific investment needs, and can research small, niche, opportunistic ideas that may apply to only one or a few clients, but would not be applicable or large enough to spread across all client portfolios.”

English suggests that institutions and their governing boards ask themselves two important questions before engaging or continuing to engage consultants. “Can they provide returns that are high enough to offset additional cost? And do these strategies actually reduce volatility?”

Despite these potential downsides, consultants likely will continue to be an important resource for endowments, especially as the number of managers continues to grow and the investment strategies used by campus endowment managers become increasingly complex.

Keeping an Eye Even Closer on the Ball

More complicated investment portfolios have brought even more attention to endowment issues, particularly from campus investment committees and governing boards. Often, investment committees want to know even more details about the efforts their managers are using to safeguard these valuable assets.

“The increased diversification and sophistication of portfolios has required a change in governance and processes,” Heck says. “Investment committees have been utilizing more professional staff, consultants, and outsourcing to identify and perform due diligence on managers, monitor risk, and fit complex portfolios into changing market environments.”

But, as Judith H. Van Gorden, former chair of NACUBO’s annual Endowment and Debt Management Forum, and former chief financial officer for the Arizona State University Foundation suggests, there are a number of advantages to this new focus on governance. “The necessary points of integration and contact—between institutional administration and investment administration—are better understood now, and are becoming well embedded in both the financial management and investment processes of the institution. This greater integration has helped to ensure that governance groups are proactively thinking about meeting standards of fiduciary conduct and providing oversight that stands up to a high level of scrutiny by a wide range of constituencies and interested parties.”

Future Challenges Ahead

The past 40 years have seen endowments transform from relatively small funds invested primarily in stocks and bonds to much larger funds with numerous combinations of traditional and nontraditional investment strategies, a much greater reliance on in-house and outsourced expertise to manage these choices, and greater scrutiny from investment committees and boards of trustees. Through it all, financial markets have been even more volatile. Investment returns, while generally still positive, have been much smaller over the past 10 years than in the 1980s and 1990s.

Given these extraordinary changes, many endowment managers see their primary future challenge as meeting their long-term return targets while generating income to meet short-term spending needs. “Over the next two or three years, I anticipate that the biggest issue that endowments will face will be operating in a lower-return environment,” Almond says. “As a result, the endowment spending policy over the next 3 to 5 years will require continued re-examination in order to preserve intergenerational equity of the funds.” At the same time, endowment managers will continue to have to balance the need for higher returns without taking on any undue risk. Heck says, “I think there is a great deal of thought being given to portfolio construction in the context of risk management, but it is still in the formative stages.”

In addition to these challenges, schools will also need to keep an eye on changes in interest rates, the economy, and other factors that will affect returns. “If the global economy slows and interest rates rise,” English says, “equity prices will experience slowing or negative returns and leveraged investments could be severely impacted.” However, as Matis reminds us, investors must avoid making hasty decisions due to this uncertainty. “Managers need to ensure that their finance committees are prepared for various scenarios, so that they remain focused on the long-term goals of the investment pool and not panic or make gut-reaction decisions.”

Staley believes that rapid changes in the investment climate bring even greater stress to governing boards. “Financial markets and investment opportunities evolve faster than volunteer, part-time fiduciaries may be able to,” she says. “Establishing investment policies that link portfolio risk with enterprise risk tolerance and constructing a multi-asset endowment portfolio that can deliver on the target risk and return objectives under these market conditions will be even more challenging.”

In the end, as Griswold says, endowment managers’ greatest challenge will be to find new investment opportunities in an era where even alternative strategies may not help performance. “In the past, endowment managers have been able to deploy more of their assets into alternatives to help generate higher returns. However, as the 2008–09 financial crisis showed, the returns of many alternatives sometimes move in concert with traditional investment classes. Safe harbors may be harder to find in the future.”

KENNETH E. REDD is director of research and policy analysis at NACUBO.