Thanks to upgraded and integrated technology, students at Drexel University, Philadelphia, no longer suffer from the dreaded “ping-pong effect.”

“Before we opened Drexel Central, students would come into the bursar’s office with a question about their bills. They would be logged in and then wait until a representative was available,” recalls Amy Bosio, vice president, finance, Drexel University.

“Then the student would sit down with the rep, who would say, ‘Oh, there’s nothing wrong with the bill. The bill is $40,000. What’s wrong is that your dean’s scholarship didn’t disburse for $20,000.’ So the student would have to sign in at the financial aid office, wait for another rep, and get the issue resolved. There was this ping-pong effect.”

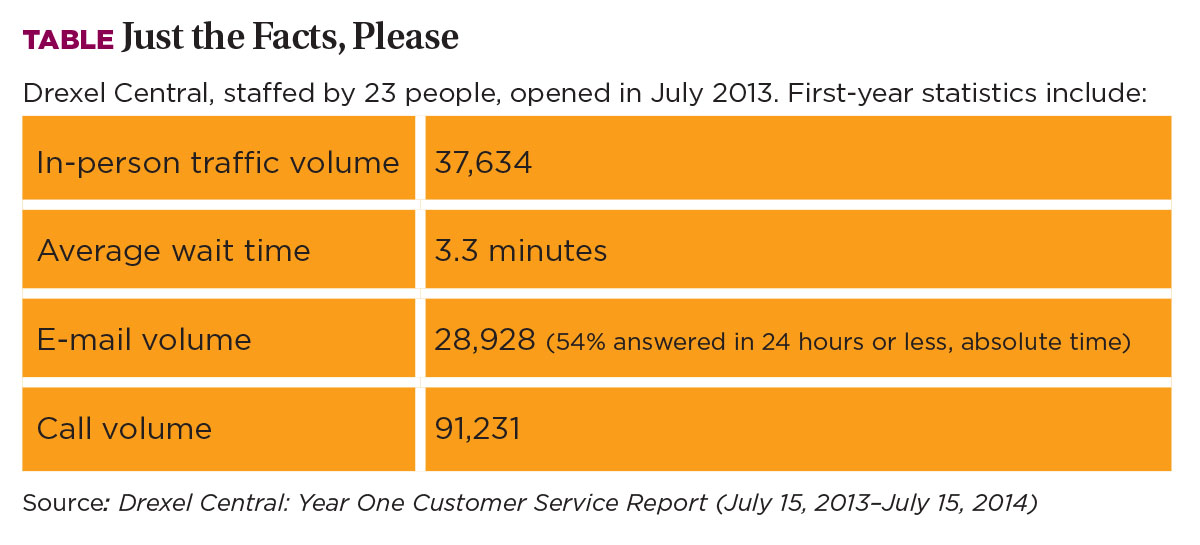

To eliminate this back-and-forth game, which nobody enjoyed playing, Drexel used a combination of automation and process improvement to open its one-stop shop, Drexel Central, in July 2013.

New phone scripts with a single point of entry now allow callers to choose automated information or to speak to a student representative. A self-service check-in kiosk features RFID DragonCard scanning that automatically opens a new incident in Drexel’s CRM RightNow to place the student in a queue to see the next student services representative. A customized dashboard screen pulls into a single location the most commonly searched Banner information to resolve student questions, and links to the student ID photo for ease of identification.

One student succinctly summed up the new service: “Way better than it was two years ago.”

Drexel is not alone in using technology to transform the way students and families interact with billing, cashiering, financial aid, and registration services. Institutions everywhere are looking at technology solutions for their student information systems, customer relationship management software, and telephone systems.

Students Demand Immediacy

“We have had to adapt and learn to embrace technology, because it’s what our students have grown up with,” emphasizes Bradley Martin, manager of communications and collections, Texas Tech University, Lubbock. “Our 33,000 students want quick responses, which we’ve had to learn to provide, while keeping the quality of our responses high.”

To meet the challenge, the institution has embraced numerous service enhancements, including the NemoQ queuing system, which allows students to text from anywhere—class, student apartment, or dorm—and reserve a space in line at the institution’s one-stop shop for financial aid and student business services. The queuing system first experienced a trial run at the end of the spring 2013 semester and went into full production for summer 2013.

“Students live in a texting world,” says Christine Blakney, managing director, student business services. “All of their communication is real time. Instantaneous. They expect that level of service from service providers as well. We understand their time is valuable, and rather than have hundreds of students in our hallway waiting for a name to be called, we’re trying to maximize our efficiency.”

To make the in-person process just as easy, the institution has installed three self-service kiosks and hired a greeter who helps direct and answer any questions. “NemoQ, driven by a behind-the-scenes server, tells students what the wait is,” Martin says. “When they come into the office, they swipe their student ID or their Texas driver’s license, giving the system access to a database that pulls up their information. Then they can select if they need to see student financial aid or student business services.”

Another enhancement is a mass upload auto-dialing system, dubbed Call-Em-All, which can reach a large population in a short time while delivering a consistent, yet customized message. “Call-Em-All is so versatile,” Blakney says. “Our financial aid offices use it to communicate to students when they’re missing documentation for their aid awards, and we use it to communicate that a student is potentially going to be cancelled from classes due to nonpayment.”

According to Blakney, a message can be released in less than 20 minutes, as long as the message’s content and target audience are known. Although the system is quick and easy to use, Blakney continues to be cautious about overuse. “We don’t let our colleges use it for advertising,” she says, “because we don’t want students to become immune to the message.”

Another big advantage: The system actually saves money. “With Call-Em-All, we are now able to reach a large population of students with a consistent and timely message instead of having teams of eight and 10 full-time student assistants make those phone calls,” Martin says. “With salaries alone, we conservatively estimate we are saving around $30,000 a year.”

With these advances, however, come technical glitches. One that comes to Martin’s mind is an Internet outage. “In our call center, we utilize customer interaction CIC software. All of our phone lines are voice-over IP. If we have an Internet outage or a network connection outage, we’re unable to make or take calls. While those [events] are rare, thankfully; they are definitely a challenge.”

To ensure students get called back after an emergency outage, call center agents open their dialogue with: “In case this call is disconnected, what’s the best number for us to reach you?”

Both Blakney and Martin offer similar advice for optimizing technology in call centers and one-stop shops. “Know your audience,” Martin says. “Listen to students whenever they provide feedback, even if they’re upset. In the last two years, we’ve been trying to find out what is frustrating our students and their parents and how we can minimize or eliminate those frustrations.”

Blakney agrees. “When you focus on students, the technological advances seem to fall into place,” she concludes.

Sometimes, It Takes a Tiger

When they wanted to improve the quality of customer service received by students, the senior academic and administrative leaders at New York University (NYU), New York City, turned to a team of tigers.

“Three years ago, NYU formulated the Tiger Team to focus on four main offices: bursar, financial aid, registrar, and residential life and housing services,” explains Andrew Hung, director, student accounts-operations. “We wanted these four main offices to come up with ways to improve how we provide services to students. We looked at not only technology, but also communications and processes.”

The team, a crossfunctional group comprising two staff members from each of four student service departments, has launched a variety of services. Among them:

StudentLink (www.nyu.edu/studentlink) is a one-stop resource for questions and information related to each of the Tiger Team departments and includes links to other websites, such as the student resource center, health and wellness, and student employment. Students can bookmark the page for quick access to the links they frequently need.

“In essence, we were trying to create a virtual one stop for the students,” explains Anthony Bonano, university bursar. “We wanted to minimize the bouncing of the student from office to office, which translates into us being able to resolve their inquiries a lot quicker. In turn, they can pay their bills, which reduces our over-all receivables.”

Because it was completed in-house, the website had a minimal price tag, Hung points out. “We have an NYU Web team. With its assistance, combined with the Tiger Team, we were able to determine how we wanted this to look, the information we wanted to display, and the process for updates.”

The page includes a calendar with important upcoming dates and deadlines. “We really want a central location where a student can get one-stop assistance from the four major categories that are nonadvising-related,” Hung adds. “On one site, students can get important information, such as payment due dates, holidays, and when registration starts, instead of having to navigate four separate sites.”

ServiceLink, a new customer tracking and resolution tool, allows a staff person to input the student’s question or issue and electronically assign it to the appropriate person or department for resolution. Automated e-mail and tracking numbers keep the student informed. NYU introduced the online mechanism in July this year.

“When a student sends an e-mail to the bursar’s office, a ticket is automatically created and recorded in the ServiceLink system,” Hung explains. “The student gets an automated response confirming that we received the e-mail, and we provide a service level agreement indicating they can anticipate a response in one to three business days.

“Next, a member of the customer service team reviews the tickets and assigns them to the appropriate person for response,” he continues. “For example, if a student receives a bill because his or her financial aid is not recorded, this service allows us to reassign the ticket to financial aid. Financial aid would see the entire progress of the entry and anything the bursar has already done.”

Once the issue has been resolved, the student receives a customized e-mail explaining how and why the ticket was closed, along with a link allowing the student to click yes or no to the question, “Was this helpful?” If the student clicks no, “we determine if additional action is required,” Hung says. “The best way to determine what changes we may need to focus on is [to review] the feedback we receive from students.”

Up next: “We are opening an in-person StudentLink center in 2016,” Bonano says. “Work is progressing now.”

Videos Show and Tell

Back in 2003, the University of Cincinnati (UC), Ohio, became one of the first institutions to adopt the one-stop model, asserts Ken Wolterman, bursar. “One of my goals is for that office to be the only one that communicates with students, so they know when they get an e-mail from One Stop it should be the one thing they make sure they read because it will have important information for them,” he says.

The customer service center, which reports to enrollment management, represents the offices of registration, student records, student accounts, and student financial aid. One Stop employs 17 staff members, including three managers, to service 43,000 students. “The idea is that students come in and take care of other business without being shuffled from one office to another,” says Wolterman, admitting that it’s a lot of information for One Stop representatives to remember.

That’s one reason that a vendor featuring a customized e-messaging system at a NACUBO conference intrigued him. As he talked to representatives at PointAcross Solutions, Wolterman wondered if he could adapt the product to demonstrate his institution’s complicated processes—sort of a show-and-tell for students and parents.

He ended up choosing a vendor package that entitled UC to a bank of 150 development hours for $8,500. “The company provides the design and voice-overs,” he says. “My staff gave the vendor a series of 30 pictures, so the videos are UC-branded.”

Since then, the institution has released nine customized videos—with more in the works—that cover such subjects as paying bills, calculating financial aid, using direct deposit, maintaining loan eligibility, setting up a payment plan, obtaining health insurance, avoiding late fees, and dropping classes.

For people who have questions about a particular topic, staff explain where individuals can see the information on the Web, and attach a code or graphic—along with a link in e-mail—so they can watch the related video, Wolterman says. “Right now, our e-mails are text-based. We want to get to a place where we do HTML e-mails and embed these videos in a mass-distribution process. We’re just not there yet.”

He is also looking forward to reviewing the comprehensive data provided by a newly installed call management system from Interactive Intelligence. “One Stop went live in July with the system, which has already given us insight about bottlenecks in our processes. If needed, One Stop reps can throw a switch and have the home offices answer calls that come in about their respective functional areas. The system can also manage e-mails and provide metrics and analytics that may help us change our processes.”

Wolterman advises business officers to equip their one-stop centers with the latest high-tech advances. “Take advantage of all these technologies,” he says. “I’m fortunate that upper management shares my vision and believes in what my staff and I are trying to do. You need that buy-in so that leaders will invest in the infrastructure.”

MARGO VANOVER PORTER, Locust Grove, Va., covers higher education business issues for Business Officer.

Law or no law, what parent hasn’t been slightly peeved when calling a son’s or daughter’s college for information only to get the privacy runaround? The response usually goes something like, “I’m sorry, but unless your daughter Betty signs a permission slip, we are not authorized to release that information to you.”

Law or no law, what parent hasn’t been slightly peeved when calling a son’s or daughter’s college for information only to get the privacy runaround? The response usually goes something like, “I’m sorry, but unless your daughter Betty signs a permission slip, we are not authorized to release that information to you.”