The following NACUBO staff members and consultants contributed to this report: Mary Bachinger, Liz Clark, Deborah Cumbo, Jeanne Cure, Bryan Dickson, Barbara DiRocco, Sally Grans-Korsh, Anne Gross, Matt Hamill, Amy Hemphill, Karla Hignite, Sue Menditto, Derek Price, Randy Roberson, Carole Schweitzer, Bob Shea, Maryann Terrana, Preeti Vasishtha, Dorothy Wagener, and Tadu Yimam.

Photographs by Rodney Choice, Choice Photography

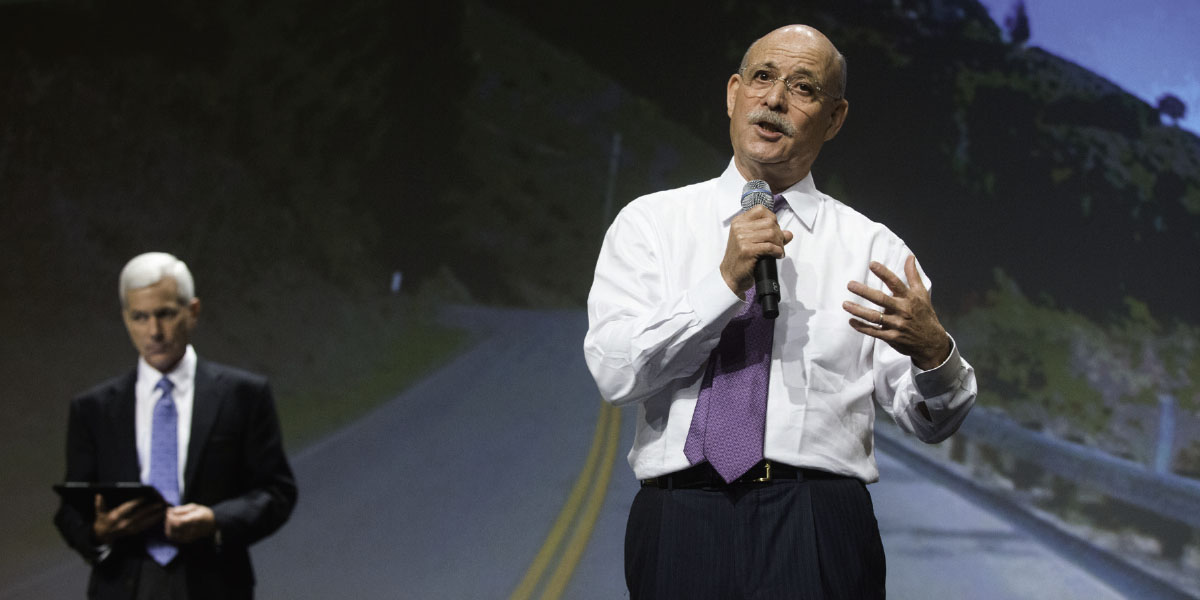

While it is probably best known for its motor speedway, Indianapolis was our choice for this year’s meeting because it exemplifies the spirit of creativity and innovation,” said John Walda, NACUBO president and CEO, at the opening general session of the NACUBO 2013 Annual Meeting. “Its eight local universities have helped fuel the region’s economic growth in health care, life sciences, and technology.”

Following on the heels of last year’s 50th anniversary celebration, NACUBO’s 43rd annual meeting drew a total of 2,389 attendees and exhibitors. Of the total, 1,410 were full conference registrants, 281 were attending their first annual meeting, and 35 came from 16 other countries.

“Using collaborative staff and member efforts,” said Walda, “we delved into the annual meeting theme of ‘Driving Innovation,’ seeking the forces that are influencing major changes in higher education. We were able to identify five drivers of such innovation that can help inform campus leaders as to establishing their institutions’ priorities.”

The single-issue edition of the July-August Business Officer covers in depth each of the drivers: changing curricular needs, stretching campus boundaries, global challenges, public perception, and changing demographics. “You’ll find,” said Walda, “that these drivers are woven into the sessions you’ll be attending during the next few days.”

Further illuminating innovation’s role in higher education, Charles Bantz, chancellor since 2003 of Indiana University–Purdue University (IUPUI), Indianapolis, summarized some of the long-term projects inspired by the needs and goals of both the university and state government. “We’re a fiscally solid and conservative state,” said Bantz, “and the state cannot borrow money. Yet Indiana has managed to achieve one of the most sustained growth rates, especially in terms of business innovation.”

What’s the secret? “We have a long history of commitment to collaboration and risk taking,” explained Bantz. “Every year, Eli Lilly spends $5 million in research—and most of it doesn’t work.” Similarly, he said, the state’s leaders took tremendous risks when devising a long-term plan to guide its future. The goals, said Bantz, “were to build on our sports base and develop tourism, infrastructure, and targeted industries. It was a conscious, innovative strategy.”

As far as academic innovation, one of the keys, said Bantz, was to focus on clusters of economic opportunity. In a state that ranked quite low in its population’s health, for example, life sciences and health care were obvious choices. “We’ve developed 12 program areas to support our goals,” said Bantz, including IUPUI’s Richard M. Fairbanks School of Public Health. And a 25-year sustained effort resulted in the nation’ first school of philanthropy, recently dedicated to the Lilly family.

In the end, said Bantz, “Academic innovation is the best way we can use our contributions for the benefit of society.”

The meeting’s opening event the night before highlighted another Indianapolis achievement, the Eiteljorg Museum of American Indians and Western Art. Attendees enjoyed a demonstration of native dancing in an outdoor courtyard and were free to visit the museum’s exhibits, which included works by artists such as N.C. Wyeth, Georgia O’Keeffe, Frederic Remington, and Kay WalkingStick. The institution’s contemporary native art collection has been ranked among the world’s best.

Continuing the spirit of innovation, this year’s annual meeting introduced a virtual conference component for those unable to attend in person, with 15 live video sessions on Tuesday, July 16. Forty-six colleges and universities signed up for the online event. Also new was programming designed in partnership with the NCAA to meet the needs of athletics business officers.

INNOVATION INCUBATOR

Put Your Eggs in Many Baskets

How do you tease out innovative thinking to position your institution apart? One sure way to kill innovation is to entrust someone to develop that next big idea, and then remind him or her not to blow it. According to general session keynote speaker Frans Johansson—bestselling author of The Medici Effect and The Click Moment—that kind of all-or-nothing pressure essentially guarantees failure. Instead, “People need the freedom and flexibility of getting multiple bites on the apple,” suggests Johansson.

- Place purposeful, small bets. A better approach is to break up pilot funding for an initiative into a series of buckets to explore wildly different ideas. Almost every great or groundbreaking innovation began as something else, reminds Johansson. Pursuing diverse hypotheses through a series of small steps can eventually lead to something truly unique.

- Follow the unexpected. Almost all innovations appear logical after the fact. Yet, many great ideas were based on assumptions that were either false or ridiculous at the outset, says Johansson. The opportunity to test an idea and to allow others to react to it can produce that moment of serendipitous response. When you do stumble across something unique, that’s the time to double down, argues Johansson.

- Insist on intersectional thinking. Diversity drives innovation, says Johansson. Cross-pollination of disciplines is also crucial to innovative thinking—allowing convergence of concepts that can produce unexpected aha moments. Johansson describes this as innovation through the side door—the indirect pathway of discovery.

- Develop either-or strategies. A strategy is merely a decision to act, notes Johansson, and the best strategies are those based on alternate realities. Move in a direction, but always remain open to diversion based on emerging trend lines. Bottom line, says Johansson: “The world moves in unexpected and serendipitous ways. You need to move with it.”

BIOSPHERE CONSCIOUSNESS

Change the Education Model

Keynoter Jeremy Rifkin gave a sobering and wide-ranging talk covering the relationship between global use of energy sources and the world economy, and enumerating the elements of an emerging “third industrial revolution.” Given the convergence of new energy and communication tools, he urged the transformation of education from a centralized model to a distributed and collaborative experience designed to instill a sense of the shared nature of knowledge—a “biosphere consciousness.”

Our current model follows a top-down, 19th-century centralized factory model, said Rifkin, an economic and social theorist, and author of The Third Industrial Revolution and other books. The teacher makes assignments; the students don’t ask questions. They’re taught that knowledge is power. If they share information, it’s cheating. And, they’re made to believe that knowledge is something you possess as an autonomous agent pursuing your own self-interest. “Learning the ‘why’s’ of things is not as important as the ‘how’s,’” he said. “We do not put a premium on critical thinking.”

It’s a complete disconnect for children growing up with the Internet, and we have to move to a collaborative, peer-to-peer approach. In order to do that, we should:

- Create global classrooms. Instead of maintaining a siloed system, we should open up to virtual space with Skype, and allow students to interact across cultures, narratives, and value systems.

- Emphasize service learning. Young people participate in service learning with the purpose of creating a sense of common social capital and fostering the realization that learning is something we do between and among people. Rifkin advocates moving service learning into pedagogy.

- Bring curriculum together across disciplines. We have to have interdisciplinary teaching, with multiple perspectives. Let students learn in cohort groups for which the teacher serves as facilitator and guide, imparting ideas while allowing students to break into groups and be responsible for their own learning.

“We need to rethink the notion of what kind of human being we’re producing” with our educational system, Rifkin said.

THE NEXT GENERATION

Educating Citizens of the World

One in five children in America has a parent born outside the United States,” noted Judy Woodruff during the closing general session. Former White House correspondent for NBC News, 12-year veteran at CNN, and current coanchor of the PBS NewsHour, Woodruff said that the fact that one in eight of those children was also born outside the United States “means they have grown up with diversity; they are not bothered by differences in skin color, ideas, or culture.”

Couple diversity with another main distinction—technology immersion—and you have, said Woodruff, “a generation that creates disequilibrium in the workplace.” Informed in part by her Generation Next project for PBS, Woodruff has learned that “young people are eager to make a difference, but they don’t like being labeled or being locked into a political position. Rather, they are more likely to want to tutor kids or do other volunteer work. And, they think of themselves as citizens of the world.”

For that reason, concluded Woodruff, “We owe it to them to provide the kind of education they need. They have been so connected all their lives that it will be fascinating to see if they take this collaborative attitude into adulthood.”

ATTAINMENT

Redesigning Higher Education

Our nation needs far more educated citizens than are now produced,” said Jamie P. Merisotis, president and CEO of the Lumina Foundation, who spoke to the NACUBO prime representatives at a breakfast meeting on Monday. “All of our work is about trying to meet that demand goal. At Lumina, our message has shifted from the what to the how—how do we get there?”

Merisotis sees two key imperatives for meeting “this urgent national need.” The first, he said, is to mobilize all relevant stakeholders to join in the effort. He praised NACUBO for the advocacy work it is doing to make higher education attainment a priority.

Second: Design a 21st-century higher education system that will offer lower-cost academic delivery and will be “a learning-based system offering pathways to high-quality credentials.” The traditional credit-hour model won’t serve the dramatically larger number of Americans who need higher education, Merisotis asserted. “Learning outcomes must be the true measure of educational quality.”

He urged chief business officers to free capital investments in noncore assets in order to support new forms of academic delivery that could serve greater numbers of students. “It’s not enough to convince your colleagues of the need for innovation,” he said. “You must be driving the innovation.”

Merisotis offered four practical steps:

- Apply institutional resources in a thoughtful, purposeful way. Align tuition and financial aid policies to encourage students to take full courseloads and graduate on time.

- Leverage your success and share that information with policy makers. “You are well-suited because you have a foot in two worlds: one in academia and one in the policy world,” he said. “Be a public advocate for system redesign.”

- Translate the details on which the new system is based. “Your expertise is absolutely critical. You must be able to articulate the financial underpinnings of the new methods of assigning value to courses.”

- Embrace collaborative leadership in your campus. “With students so diverse and the consequences of failure so dire, the academic and business sides must work together,” said Merisotis. “No business office has the luxury of focusing solely on the numbers; your job is ultimately about people.”

PROFESSIONAL DEVELOPMENT

Boost Strengths, Tailor Message

Monday morning options included a variety of concurrent sessions designed to encourage personal professional development. Here are a few examples.

Double Down on Your Assets

In “Leveraging Your Strengths at Work and in Life,” Mark Saine, senior director of executive and leadership development at TIAA-CREF, identified myths related to personality and engagement—namely, that as you grow, your personality changes, and that you will grow the most in your areas of greatest weakness. In fact, said Saine, over time you will become more of who you already are, and you will grow the most in your areas of greatest strength.

Why, then, do most of us in our own professional development focus primarily on improving areas in which we are weak? Conventional wisdom suggests that by improving a weakness we somehow become more whole. However, from a more practical standpoint, noted Saine, wouldn’t it make more sense to identify others for your team with strengths to fill your gaps?

Saine drew from Strengths-Based Leadership by Tom Rath and Barry Conchie. They argue that the most effective leaders invest continually in strengths, surround themselves with the right people, and understand their followers’ needs. In fact, leaders who invest in boosting strengths enjoy a 73 percent level of engagement from employees versus 9 percent engagement from employees whose leaders focus primarily on improving weaknesses. “As leaders we have a unique role in helping people find and capitalize on their strengths,” said Saine.

And the payoff is real, he added. Saine points to the business case made by Marcus Buckingham in his book Discover Your Strengths. According to Buckingham, teams that play to their strengths every day are 50 percent more likely to have low employee turnover, 38 percent more likely to be high-productivity teams, and 44 percent more likely to earn high customer satisfaction scores.

Tailor Financial Message Takeaways

“Your main communication goal is to predetermine the message your audience will ultimately remember,” said Lorraine Arvin, associate vice president for finance and administration and treasurer, University of Chicago. During the presentation “Communicating Financial Information Effectively,” Arvin, along with Howard Teibel, president, Teibel Inc., described the steps of the communication plan used by the university’s financial team.

- Determine your goal. Many presentations, explained Teibel, are not so much about conveying the institution’s finances as they are about establishing a two-way dialogue with the audience.

- Assess your audience. Student interest, for example, would center on rising education costs, tuition prices, and how finances tie back to the student experience.

- Tailor your message. For example, Arvin said, “With a student audience, I always want to talk about financial aid, because tuition doesn’t tell the whole story.”

- Choose strategies and vehicles. To report to the board, “it’s worked for us,” said Arvin, “to provide concise executive summaries presented in a consistent format.”

- Practice. “You can’t be effective if you don’t practice your delivery,” said Teibel. “And, remember to focus on your opening remarks. People will decide within the first minute whether or not they will stay and engage with you.”

Define Your Direction

“The job you were hired to do may not be what it looks like today,” Diane Fenning, senior consultant at the Human Capital Group Inc., told attendees during her session, “Top 10 Strategies for Managing Your Career.” Most professionals have in mind what they believe to be the right trajectory for their career; however, this may cause many to miss capitalizing on opportunities. While keeping the everyday workload moving forward, you also need to keep at the forefront where you want your career to excel, and to be thinking, “What’s next?”

Fenning offered nine other strategies including:

- Education. Is more education the answer? Yes may seem like a biased answer, but Fenning reminded attendees, “This is our product.” Whether in the form of an advanced degree, certification, or other designation, business officers need to stay well-versed and current.

- Enlist a mentor and/or champion. You need to have three to five diverse individuals with whom you feel comfortable having candid conversations.

- Raise your hand. Get yourself out there and volunteer—it’s good exposure, and others will get to know you in different roles.

- Define and craft your network. Fenning advised, “Make friends before you know you need them.”

- Become a mentor and/or champion. Giving back what you have gained creates and stretches your network.

- Support your teammates. This is very important to your career, Fenning said, because it will be remembered and referenced.

ATHLETICS BUSINESS OFFICERS

Better Partners

Understanding the Governance and Financial Impact of Athletic Programs” was one of several sessions within a track organized by NACUBO in partnership with the National Collegiate Athletic Association (NCAA). This session and others were designed to nurture partnerships between athletic departments and business officers.

Among the audience were chief and athletics business officers who posed challenging questions for a panel that included Dr. Guy Bailey, former president/chancellor at the University of Alabama, Texas Tech University, and the University of Missouri‒Kansas City; Rick Anderson, vice president for administration and treasurer, Washburn University, Topeka, Kansas; Kathleen McNeely, vice president of administration and chief financial officer, NCAA; and Rick Legon, president, Association of Governing Boards of Universities and Colleges (AGB).

The panelists offered observations and suggestions for business officers:

- The value of the NCAA dashboard indicators cannot be overestimated. The president, athletic director, and CBO at each NCAA Division I, II, or III member institution receive the dashboard indicators, which include valuable benchmarks that can be used to inform the direction of the institution’s athletic program.

- CBOs and other senior leaders should more clearly communicate the high grade-point averages and academic success of student athletes, putting to better use positive statistics about athletics on campus. Studies show that these successful graduates often aspire to leadership positions.

- The amount of media contracts is likely to increase in the coming years. These contracts can significantly offset athletic program expenses. Kathleen McNeely predicts that because of this, the number of NCAA Division I institutions that operate unsubsidized could increase in upcoming years.

- It is a governing board’s responsibility to understand finances around athletics. The Statement on Board Responsibilities for Intercollegiate Athletics, published in 2009 by AGB, points to NCAA key data indicators that are highly useful to governing boards. Legon urged chief business officers to utilize this resource and, “Help your board carry out what they are legally required to do.”

Other sessions in the track for athletics business officers included “Communicating and Building Relationships With Campus Administration,” “NCAA Reform Initiatives,” and “Strategic Planning for an Athletic Program.”

DOING THE NUMBERS

Toward Clarity in Reporting

Sessions in this track surveyed current issues and best practices in the core business office functions of accounting, tax administration, and compliance.

A Fresh Start to Financial Reporting

Sessions on accounting updates for public and independent institutions featured a new approach to financial reporting known as the Blank Slate Project. NACUBO’s Accounting Principles Council has created a set of innovative financial statements, with key disclosures, in an attempt to better explain higher education’s mission and financial results to stakeholders.

The project began as an advocacy effort aimed at the Financial Accounting Standard Board’s (FASB) work on the not-for-profit (NFP) reporting model. Because public colleges and universities follow Governmental Accounting Standards Board (GASB) pronouncements—and higher education is one industry—the new concepts have also been presented to GASB representatives.

Presenters noted how discussing the Blank Slate model with both boards helps to educate the standard setters about user issues and questions that financial reporting ought to be addressing. The concern is that although NACUBO may assist the FASB in its quest for enhanced financial reporting and transparency, a changed NFP reporting model would ultimately widen the reporting schism between public and independent institutions.

The Blank Slate reporting model focuses on an institution’s resources and describing how resources are used or conserved for a future period. Resources are multifaceted and are categorized based upon either internally or externally imposed restrictions or utility. The broad categories are:

- Undesignated resources.

- Designated resources (external and internal).

- Endowment (external and internal).

- Net property plant and equipment (all assets with service value net of related debt).

Further, communicating an operating metric is the fundamental purpose of an income statement that is designed to help the public understand and distinguish among support revenue, fee-for-service revenue, endowment spending, and gains and losses that can be related to either future obligations and/or resources. A new statement that explains how resources change from year to year is added and enhanced disclosures clarify how students pay for college, institutional aid, liquidity, and educational expenses.

(Front row, left to right) Chuck Barrick, Laserfiche; Steve Pribyl, Follett; Patti Girardi, Chartwells; Walda; Larry Ladd, Grant Thornton; Lynn Wiatrowski, Bank of America Merrill Lynch; Kelly Jones, Sibson Consulting; Moira Kirkland, Ellucian; Lynn Rodman, Fidelity Investments; and Gary Wilson, E&I Cooperative Purchasing. (Back row, left to right) Brian DeWitt, Whiting-Turner; Lew Burley, TIAA-CREF; Tim Gorman, BDO; Orson Morgan, VISA; Howard Tiebel, Tiebel Inc.; Marlene Wilson, Jenzabar; Don DiLoreto, Wells Fargo; Lisa Schneider, Russell Investments; and Rob Reach, Higher One.

Minding Your Defined Benefit Pension Plan

Coping with the financial liability of an underfunded defined benefit retirement plan, even those closed to new participants for some time, requires colleges and universities to consider a range of issues before settling on a strategy.

Participating in the session “Stakeholder Views and Institutional Responses to Underfunded Pension Plans” were Giselle Tremblay, a senior pension specialist with Bank of America Merrill Lynch; John Shipley, vice president and treasurer at the University of Miami; Diane Viacava, a vice president and senior credit officer in Moody’s; and Frank Williams, a senior vice president with Bank of America Merrill Lynch.

After reviewing the various reasons why many defined benefit plans have become increasingly underfunded, panelists explored the potential advantages, and disadvantages, of borrowing in today’s low-interest-rate environment to secure the capital needed to bring a pension plan back into balance. Their conclusions: Consider implications for your cash flow, your key financial ratios and how they will be perceived by various stakeholders, your investment policy (particularly if you borrow to prefund this liability), and your risk tolerance.

Within the institution, practical questions to engage others in a broader conversation about pension benefits and long-term cost implications include these: Is the board fully informed of the situation and the options? Are the benefits offered in our defined benefit plan richer than other plans the university offers, and/or richer than what other universities offer? What other retirement options can we offer?

Thinking through best approaches for funding and managing your defined benefit plan or transitioning employees to other plan options is a necessary step to minimizing your balance sheet risk.

Two Different Languages

Imagine that the development office reports to the trustees that they met all the campaign fundraising goals, but then the business office reports that there’s no money on hand. What is the issue? This was the topic explored in the session, “Bridging the GAAP Between the Development and Accounting Departments.”

“The issue really comes down to development ‘counting’ gifts versus accounting ‘recognition,’” said presenter Pete Ugo, partner with Crowe Horwath LLP. “You can’t pay the bills with pledges and bequests.”

The accounting method is to follow generally accepted accounting principles (GAAP) for contributions, with a preference for unconditional, nonreciprocal gifts that cannot be rescinded. Development officers focus on relationships with donors and recognition for their intention to give, which can lead to counting a gift both when it is pledged and when it is collected.

The two different approaches can lead to audited financial statements that are inconsistent with internal reports, as well as other questions such as when to give naming rights in a capital campaign or when to start construction of a building.

“At DePauw, we have a policy of having 100 percent commitment and 75 percent cash on hand before beginning construction,” said presenter Brad Keilsheimer, vice president for finance and administration DePauw University, Greencastle, Indiana.

The session included suggestions for “bridging the GAAP,” such as:

- Understand the fundraising goal and what will actually be available to spend.

- Keep the board informed, including the amounts of deferred gifts and planned gifts.

- Reconcile often between development records and accounting records.

- Develop and document a gift-counting policy and a gift acceptance policy.

CULTIVATING LEADERSHIP

Advice For Senior Leaders

In addition to the Monday morning concurrent sessions on personal professional development, there were numerous additional sessions on other aspects of leadership. Here are a few examples.

Toward Better Student Financial Aid Policies

Are institutional aid funding decisions, awards, policies, and practices consistent with the mission and values of the institution? That’s the question that a joint project, conducted by NACUBO and the Association of Governing Boards (AGB), set out to answer. In the session “Creating Metrics to Guide Institutional Financial Aid Policy,” Kenneth Redd, NACUBO’s director of research and policy analysis, moderated a panel discussion explaining the purpose, scope, and next steps of the project, funded by the Robert W. Woodruff Foundation.

Panel participants included David Walker, vice president for finance and planning at Messiah College in central Pennsylvania; and Betty Roberts, senior vice president and chief financial officer, Alcorn State University, Lorman, Mississippi.

Institutional grant aid exceeds $42 billion annually, according to the College Board. The NACUBO-AGB project focuses on developing metrics to help senior leaders understand how this significant amount of aid is being used and what specific data can help in making aid decisions that support institutional mission. Roberts noted that “financial aid is a critical component of who we are, because of whom we serve. As a public and historically black institution, we need to be more strategic in our decisions about institutional grant aid.”

Walker said, “We’ve been too myopic in focusing our enrollment management actions on bringing in the fall class,” he said. “We are using this project as a basis for longer-term considerations on the part of our leadership team—and ultimately our trustees and advancement committee.”

The panel concluded by noting that the set of common institutional aid metrics identified by the project can help colleges make data-informed decisions about how they use institutional grant aid. This fall, presidents of 17 colleges and universities will test these metrics via an online tool AGB and NACUBO are developing.

The Changing Role of the CBO

“We have a pipeline issue,” said Marta Perez Drake, vice president for professional development at NACUBO. “It’s not because our members are unhappy, it’s because our members are getting older.”

Drake led off the session titled “Preparing for the Future: The Chief Business Officer’s Evolution” with some findings from NACUBO’s 2013 National Profile of Higher Education Chief Business Officers (available as an online research publication at www.nacubo.org). She noted that 55 percent of CBOs are over age 55, and 40 percent said their next move would be retirement. “Who’s going to fill all these positions?” she asked.

“What can we do now to prepare a lifeline? You need to cultivate your direct reports—and think about women, people of color, and those who come from nontraditional areas” as future CBOs, she said.

Almost half of NACUBO’s CBO members are from small institutions, said panelist Robert Moore, vice president of finance and administration and treasurer, Colorado College. “The highest dissatisfaction with the job is at the smallest institutions, and it’s hard to do succession planning there because teams are small.”

Key concerns of CBOs were the focus of a recent survey conducted by Gallup for Inside Higher Ed and reported on by Doug Lederman, the publication’s coeditor. For example, results showed that 27 percent of business officers had strong confidence in the viability of their institution’s business model over the next 5 years, but only 13 percent were confident that the financial model would be sustainable over 10 years.

As CBOs address major financial issues, they must partner with other campus leadership, panelists said. “If others haven’t embraced the challenge, particularly on the academic side, how do we both educate them and work collaboratively?” asked Jennifer “J.J.” Davis, senior vice president for administration and finance, George Mason University, Virginia.

FINANCING THE ENTERPRISE

Rethinking Debt and Revenue

Sessions in this track presented the latest in endowment management, liquidity, and debt.

A Complicated Fiscal Outlook

“Higher education continues to be a valuable long-term investment,” said Edith Behr, vice president and senior analyst, Moody’s Investors Service Inc., in the session titled “New Approaches to Funding Higher Education.”

Even with that acknowledgement, she noted that Moody’s placed a negative outlook on the higher education sector early this year because of the pressure institutions are facing on all revenue streams, including tuition revenue, federal student aid dollars, and research funding. Yet despite these pressures, John Augustine, managing director, Barclays Capital, noted that colleges and universities are presently attractive to investors and institutions, and “can once again call their own shots in the debt market.”

Overlaying such factors with their institution’s educational and research missions, business officers at the Ohio State University (OSU) recently undertook a study in an effort to understand how best to allocate limited resources to achieve desired changes. The university conducted a “look-back” at the previous 25 years, examining not only university finances, but also student finances, student debt, tuition, government support, philanthropic giving, and other factors.

Geoff Chatas, OSU’s senior vice president and chief financial officer, outlined how this review led to a current strategy of placing the institution on a firm financial foundation by identifying areas for savings, redirecting existing funds, and growing new and innovative revenue streams—including commercializing research, building the university’s endowment, and utilizing unique outsourcing opportunities.

Strategic Debt Management

Risk should be a primary focus when institutions consider restructuring their debt portfolio or taking on new debt, according to Remy Hathaway of Prager & Co. in the session, “Active Management of the Debt Portfolio.”

Starting with risk, and taking into account various types of risk, allows the institution to decide where and how much risk is acceptable. Hathaway broadly categorized portfolio risk as debt service risk and liquidity risk. But he also warned about an often-overlooked category, which he termed “brain damage” risk. How much management and staff time is dedicated to managing the debt portfolio? How much time does the board spend on it?

Sherry Mondou, University of Puget Sound, and Thomas Richards of the University of Missouri System Office, joined Hathaway to talk about their efforts to improve debt management strategies at two very different institutions. Puget Sound needed to expand on-campus housing but first wanted to assess its outstanding debt portfolio and better match its risk portfolio to the board’s risk tolerance. The first step was to refine the university’s debt policy, followed by a comprehensive risk analysis and a rebalancing of the portfolio.

The University of Missouri under-took a strategic restructuring of its $1.3 million debt portfolio and the launch of a $350 million commercial paper program. In the end, the university increased its total variable rate debt while decreasing its daily self-liquidity requirement by $20 million.

Streamlining the Structure

The arrival of a new chief financial officer at Virginia Commonwealth University, Richmond, Virginia, served as the catalyst for streamlining organizational efficiency across the institution. In a session titled “Collaborating to Create Efficient Financial Structures,” three campus leaders detailed how VCU, its related foundations, and the VCU Health System drove cultural and structural change to become a more efficient organization—and then took those savings and invested in the institution’s strategic plan.

Describing a complex change management process involving dozens of separate and distinct financial entities were David Hanson, chief operating officer and senior vice president; Pamela Currey, associate vice president; and Thomas Burke, interim vice president for development and alumni relations. The steps involved creation of a 17-member universitywide financial structure task force; creation of a financial integrity stewardship committee; development of a financial services request for proposals; and implementation of various changes recommended by the financial structure task force.

And all this transpired over a period of 18 months.

This was the first time in his two-decade career at VCU, said Burke, that all financial stakeholders had been together in the same room to discuss the merits of streamlining financial and investment operations to gain economies of scale. Hanson con-cluded, “Traditional financial resources for higher education are strained—we have to maximize what we have.”

SERVING THE STUDENT

Spreading Financial Literacy

At the concurrent session, “Student Financial Literacy Strategies That Work,” panelists at two research universities—one public and one private—discussed how the institutions have successfully implemented financial literacy programs to help students manage their finances not only in college, but also after they graduate.

Andrea Pellegrini, visiting assistant director, university student financial services and cashier operations, University of Illinois at Urbana-Champaign, said the USFSCO’s Student Money Management Center employs both proactive and reactive approaches to spread financial literacy among its students in its three campuses located in Chicago, Springfield, and Urbana-Champaign. These include a financial literacy requirement, webinars, a Web site (http://studentmoney.uillinois.edu), e-mail and video outreach, a savings competition, workshops with other departments, and social media.

Ruth Sharp, bursar at the California Institute of Technology, Pasadena, said six percent of the institute’s operating revenue comes from student tuition and fees, making timely payments from students critical to the institution’s functioning. Contributing factors that lead to financial mismanagement by students include lack of a role model; familial and obligatory responsibilities, especially among international students; risky or addictive behavior; and disorders such as attention deficit disorder or Asperger’s syndrome that create an inability to organize budgets. The university has created six programs in partnership with other departments to target students at risk for financial mismanagement.

ORGANIZATIONAL EFFECTIVENESS

Good Governance Needed

In these sessions, attendees considered how they can redesign and implement new business practices, overcome resistance to institutional change, and cultivate efficiency.

A Road Map to Best Practices

Few institutions have faced a challenge of the gravity and scope as that encountered by the Pennsylvania State University (PSU or Penn State) in November 2011—and again when it received the Report of the Special Investigative Counsel (the “Freeh Report”) on matters relating to child sexual abuse on campus and alleged failures by university leadership.

Stephen Dunham, Penn State vice president and general counsel, and Pamela Bernard, vice president and general counsel at Duke University, discussed how the recommendations serve as a blueprint for good governance and risk management for any institution.

Dunham emphasized that the report’s recommendations are viewed by Penn State’s leadership as a road map for best practices, helping the institution to establish a new risk mitigation and management structure.

The report included 119 specific recommendations for PSU, including expansion of faculty and staff training programs and increased background checks (both initial and annual) for individuals working with minors, new staff training programs, and beefing up campus security training.

Key to Penn State’s response was the creation of a new administrative structure to assess and execute recommendations. This new structure included a response team composed of subcommittee chairs of the PSU board, including HR and legal subcommittees. An administration response team was composed of the vice president for administration, the senior vice president for finance and business, and the vice president and general counsel. Working with the board and administration teams is an advisory council including representatives from the faculty senate, the academic leadership council, students, medical center staff, and administration and athletics staff.

Noting that preparation prior to a controversial incident is critical, Bernard encouraged all institutions to take advantage of Penn State’s efforts in shoring up their own campuses’ crime and abuse prevention policies and practices.

A Strategy for Stability

For Matt Easdown, deputy chief financial officer and director of corporate finance at the University of Sydney, Australia, financial sustainability “can mean the gradual adjustment to a changing landscape or a sudden lurch in response to a major policy reversal.” It was the latter for Easdown, when in 2011 the Australian government no longer provided “funding clusters” to support much of the cost of education delivery, and it removed student quotas.

In the session “Using Data Analytics to Achieve Financial Stability and Trans-parency,” Easdown and copresenter Anthony Pember, chief executive officer, Pilbara Group Inc., explained the process of creating a new strategic plan to control costs and keep budgets balanced.

“We had to break away from the old funding models,” explained Easdown, “and make each of our 16 entities [faculties] responsible for its own numbers.” To accomplish that, the financial staff had to unbundle established—and often “covert”—arrangements that had made it difficult to reflect the true costs associated with various programs.

By analyzing the related data, explained Easdown and Pember, the business office was able to establish that a number of faculties were not self-sustaining, many were financially troubled, and cross-subsidies between faculties masked further budget issues.

“We’ve now moved to a new economic model,” explained Easdown, “in which we’ve established business centers based on retention of direct revenues and allocation of central services based on consumption. The idea is that over the next five to seven years schools will learn how to better manage their budgets so that they eventually work their way to financial sustainability.”

PLANNING AND BUDGETING

Aligning Campus Resources

In these sessions, attendees heard how to incorporate integrated planning, financial modeling, performance measurement, and other innovative strategies into their institutions.

Data to the Rescue

Many institutions facing budget difficulties are considering comprehensive reviews of academic portfolios and administrative units to identify potential cuts—a process that can take a year to complete, at best. National Louis University had three months.

Christine Quinn, NLU provost, and Marty Mickey, vice president of finance, shared their experiences in the concurrent session “90 Days to Rightsizing and Realigning Resources.” Quinn and Mickey knew that across-the-board cuts were not an option, so they gathered faculty and staff into three task forces: academic portfolio prioritization, administrative unit prioritization, and communications. A steering committee—the president, provost, vice president of finance, and human resources director—oversaw the process.

The academic portfolio task force reviewed every program with data centered on student demand, program resources and outputs, outcomes, revenue and expenditure profiles, and opportunities for growth and efficiency. After ranking and weighing the different metrics, each program was placed into a quartile: eliminate, reengineer, maintain, or enhance.

Similarly, the administrative unit task force conducted a data-informed examination of all administrative units, looking at strategic importance, internal demand, external demand, and cost analysis, among others. The communications team sent weekly, honest updates on the process.

After ranking the programs and units, the committee chairs met with budget heads to discuss the results, the budget heads integrated recommendations into their detailed budgets, and the finance department presented the budgets to the board.

The result? Although budgets were reduced 15 percent, the 2012–13 year-end bottom line indicated a $1.2 million surplus. The project further reinforced the culture of shared governance and transparency, and increased awareness of the university’s financial condition.

While this was a data-informed process, Quinn reminded attendees that “it is not just about the data. It’s about the people you’re taking on this journey, as well.”

Financing Online Education

Emerging from a new information-sharing partnership between NACUBO and the University Professional and Continuing Education Association (UPCEA), the concurrent session “Evolving Business Models of Online Education” offered insight into the structure and trends in distance education.

A portion of the session focused on the results of a recent UPCEA benchmarking survey, in which approximately 300 UPCEA members participated. The survey found that about 36 percent of all continuing education students are taking courses online and slightly more than half of those online enrollments are undergraduate. Half the schools charge different tuition rates for online courses (compared to on-campus courses), but the majority of schools do not assess different rates for in-state online students and out-of-state online students.

Institutions invest $8,000 to $12,000 on average to develop an online course, but there is much variation in the responses. For many institutions, the cost of online course development includes a $2,000 to $4,000 average stipend given to faculty members to develop the course. Organizationally, 62 percent of online units report to the continuing education unit, while 23 percent report directly to the provost.

Nearly a third of institutions offering distance education return all revenue to central administration, while only 15 percent keep all revenue within the distance education unit. The survey found that a typical institution has 10 to 18 full-time-equivalent employees supporting online education.

Staying Ahead of the Crumbling Campus

In the concurrent session “Budgets, Buildings, and Balance Sheets,” two institutions provided insight on how they approached deferred maintenance on their campuses, after two panelists provided nationwide data to set the stage.

David Kadamus, president of Sightlines LLC, shared several interesting data points related to the age of campus facilities. In 2012, 42 percent of campus space at public institutions was 25 to 50 years old, and 18 percent was over 50 years old. At independent institutions, only 29 percent of the space was 25 to 50 years old, though 27 percent was over 50 years old.

Kadamus noted that both public and independent institutions cut capital investment in existing space after 2009, though independent institutions recovered more quickly. Now, as Lee White of GK Baum explained, public institutions have an average capital spending backlog of $79 per square foot, while independent intuitions have a slightly lower backlog of $76.

David Hanson of Virginia Common-wealth University explained how his institution’s enrollment has continued to grow at a rate above the growth in square footage. One of VCU’s key strategies is increasing the use of public-private partnerships in building multiuse facilities.

Craig Woody of the University of Denver then walked through the process of identifying spending backlogs, creating funding plans, and tracking performance related to the plan. Key to the DU strategy was replacing old space by building new, to eliminate deferred maintenance. Woody reported that over the last 17 years, the average age of the square footage on campus has decreased by eight years. Further, 83 percent of the total square footage of campus is either new or subject to major renovation.

RUNNING THE CAMPUS

More Emphasis on Disclosure

In these sessions, attendees heard how to manage risk, address security concerns, systematically evaluate facility and energy needs, and more.

Health-Care Compliance Prep

Increased reporting, recordkeeping, and participant disclosure obligations are among the compliance headaches facing higher education institutions under the new health-care law. In “Health Care Reform: Strategies for Compliance,” H. Frasier Ives, senior vice president and benefits compliance practice leader for Wells Fargo Insurance Services, urged frequent and ongoing conversation among senior leadership to ensure that everyone understands the new rules and to develop a compliance strategy.

Given the complexity of the mandates, and with so much still in flux with actual implementation of the law, Frasier suggested that what-if scenario planning can be helpful so that leaders remain flexible with their strategies and approaches as final decisions are announced.

In looking down the road, Frasier expects growth of consumer-directed health plans to accelerate, especially those that condition employer-funded contributions to funding vehicles such as health savings accounts based on employee engagement and wellness activities. While interest in transitioning employer funding of health coverage toward more of a defined contribution model (private exchanges) is growing, it is not clear how fast this may occur.

And, while technology solutions are becoming available, many technical legal issues, carrier underwriting and pricing concerns, and severe internal equity/compensation/HR issues must be addressed.

For at least the next five years, the health insurance market will be highly dynamic as all stakeholders (employers, individuals, carriers, providers, governments) adjust and readjust to the law, noted Frasier. Likewise, health-care delivery systems will become more consumer-centric. This will make employer communication strategies crucial moving forward, he added.

Clery Compliance Increasingly Complex

“The annual security report required by the federal Jeanne Clery Act is growing in length each year,” said Blaine Nickeson, assistant vice president for campus relations and chief of staff, Auraria Higher Education Center, a Denver-based three-university shared services collaboration.

The act, which took effect in 1991, requires U.S. colleges and universities to release crime statistics and security policies to current and prospective students or employees. “Documents can be 20 to 25 pages long, partially because more data can now be accessed. The expanded reporting requires compliance to become a multidisciplinary activity.”

Nickeson reminded session participants that not only are penalties for noncompliance expensive, “but the biggest issue is loss of reputation, for which there is no price.”

The Clery Act requires development of the institution’s policy statement, reporting of crime statistics—including sexual assaults—and establishment of a bill of rights. Challenges to compliance, pointed out Alison Kiss, executive director, at the Clery Center for Security on Campus, include:

- Inconsistent or nonexistent underlying policies and practices.

- Failure to survey all campus security authorities and local police and law enforcement.

- Lack of training in the details and requirements of the Clery Act.

- Poor recordkeeping.

- Lack of institutional support.

Ways to ensure higher levels of compliance, suggested Nickeson, include “putting someone in charge of training, making the appropriate people accountable for collecting specified data, and instituting a train-the-trainer program.” Nickeson and Kiss also pointed out checklists and other resources that are available at www.clerycenter.org.

Ensuring High Security Standards

Campus leaders from several colleges and universities explained the benefits of obtaining accreditation for institution safety and security operations. “It’s an important step in giving the campus and surrounding neighborhood confidence in our department and its activities,” said Ken Valosky, vice president for administration and finance, at Villanova University, Villanova, Pennsylvania.

In the session “Campus Public Safety Accreditation,” presenters discussed the process, which they said made continuous improvement of safety and security issues a “systematic activity.”

Connie Sampson, Georgia State University’s assistant vice president and chief of police, discussed the process of applying for accreditation from the International Association of Campus Law Enforcement Administrators (IACLEA), membership of which includes 1,200 individuals and member institutions worldwide. “It’s been a hallmark program since 2007,” she said, “and is governed by a commission in charge of writing standards.”

IACLEA’s program is intended to support professionalism and safety outcomes, and its annual fees provide the institution with a yearly self-assessment. In addition, said Villanova’s David Tedjeske, director of public safety, members receive a lot of support from one another in terms of process preparation and training.”

“We think of our safety and security accreditation as a key part of the overall accreditation process for the university,” said Valovsky. “It took Villanova three years. Once you do it, you’ll really value it.”

GLOBALIZATION

Making Your Mark in the World

Sessions with a global or international focus were flagged in the schedule. Here are highlights from two of them.

Gateways for a Global Presence

At a session, “Expanding a University’s Global Presence: Strategic and Financial Issues,” representatives from the Ohio State University (OSU) and New York University (NYU) discussed the two models they have developed to increase their institutions’ global footprint.

Ohio State has set up global gateways—offices in different countries—that act as embassies on behalf of the institution, said Christopher Carey, OSU’s director of global gateways. These multidimensional, multipurpose platforms engage the academic, business, and alumni communities in activities, including study abroad, internships, institutional partnerships, and revenue-generating corporate partnerships, such as advising companies on career services, research, and consulting.

OSU opened its China gateway in Shanghai in February 2010, while the office in Mumbai, India, opened in March 2012. In 2014, OSU plans to open a gateway in São Paulo, Brazil. In order to choose these sites, OSU undertook a survey to find out where its faculty is engaged in the world in terms of research; where the students and alumni come from; and where Ohio companies are most engaged globally.

NYU initially considered itself to be a “global university” and expanded its study abroad programs and developed a broader international research agenda. Now, the institution considers itself to be a “global network university,” which has led to the creation of full-service campuses abroad.

NYU has 11 international academic centers in Africa, Asia, Europe, North America, and South America, including NYU Abu Dhabi, which opened in September 2010, and NYU Shanghai, where the first 300 students will matriculate this year. “For us it was the question of where it makes sense for us to set up global sites that tie with our academic mission,” said Stephanie Pianka, NYU’s vice president, financial operations and treasurer.

NYU’s global network allows students and faculty to move around freely in a circulatory system of multiple campus locations. Its administrative functions (such as enrollment management, financial planning, HR, and student services) are fully integrated and coordinated.

Lessons From the German Experience

What can American institutions learn from changes taking place in the German postsecondary education system? Presenters in the session titled “Transatlantic Lessons in Optimizing Institutional Effectiveness” summarized findings of a Fulbright Educational Experts seminar last fall, in which they were U.S. participants along with representatives from German institutions.

The seminar was designed to identify best practices in “doing more with less” at German and American public research universities. Participants met and compared notes regarding technology, business process, staffing, outsourcing, facility construction and management, instructional design, and revenue enhancement strategies to optimize institutional effectiveness.

In the past decade, German public institutions have restructured administrative and academic processes. Much of it can be tied to Bologna process reform, intended to strengthen the competitiveness of European higher education, foster student mobility and employability, increase compatibility across nations and institutions, and create standardized frameworks. Implementing the process in Germany required major curricular reform, and was not popular with more traditional faculty, especially research university faculty.

The team of 15 American CFOs experienced the case studies of five different German institutions. Americans found it surprising that German higher education employees are completely protected from dismissal, and that 100 percent of funding comes from the government and research—there is no tuition for public institutions. No tuition means no financial aid and no massive billing process.

Among other German efficiencies: Faculty workload is higher than at most U.S. institutions, with four to five courses per semester plus research; and bachelor degrees are usually completed in three years. Industry collaboration and coordination were essential in the success of Bologna process reform, as the business office was much more involved in classroom decisions than they are in the United States.

The Americans conveyed the importance of the CFO role, professionalizing the business side of higher education, and diversifying revenue sources.

SUSTAINABILITY

Collaboration Brings Results

Several concurrent sessions brought a sustainability focus to other topics, from academics to new building technologies to space use.

In one, “Collaborative Approaches to Sustainability and Energy Management at Community Colleges,” presenters described both a statewide effort as well as specific practices of one college.

Across the state, the Illinois Green Economy Network (IGEN)—a president-led consortium of 17 community colleges—has created and delivered more than 30 online hybrid job degrees or certificate programs. The IGEN partnership has improved the academic platform that supports traditional and advanced training in new building skills such as electric machinery, industrial pneumatics, and energy auditing. Further, it fosters community engagement in sustainable practices by local entrepreneurs, small businesses, trade laborers, and residents.

Speaking for one of the participating schools, Rock Valley College, was Sam Overton, vice president of administrative services. RVC serves six Illinois counties whose major industries are aerospace, automotive, hospitals, construction, and agriculture—and the college has integrated core values of sustainability into all its academic programs.

The college has also implemented creative energy efficiency programs in its facilities master plan. Among its specific efforts are geothermal systems that support heating and cooling; cogeneration for electrical power; energy recovery systems; chilled beam construction (which augments and reduces need for air conditioning); water management features such as on-demand sinks; and other features such as white and green roofs, bioswales, and rain gardens.

At another session, “Renewable Energy Installation Ideas for Your Campus,” presenters from two public institutions shared specifics of projects designed to help campuses become carbon neutral. Both examples had unique funding sources that included private banks and university foundations.

Thomas Sonnleitner, vice chancellor for administrative services at the University of Wisconsin-Oshkosh, described two off-site bio digesters that are supplementing the institution’s overall energy use. One of the digesters is located near the largest dairy farm in Wisconsin, with 9,600 cows; the other is a small-scale digester that produces 64 kilowatts of continuous electrical power but also processes and improves the waste stream of 2,000 tons of cattle manure and bedding. George Getgen, director of facilities management for the University of California, discussed UC’s biogas facility project now under way.

The “Space Analytics” session featured staff from Queensborough Community College, the City University of New York, who implemented a Web-based master planning system to create the most efficient scheduling and space allocation. The campus, through scheduling analytics and frank, open discussions with faculty, was able to recover more than 23,000 square feet of space that can be used for new priorities.

The exhibit hall featured the products and services of 178 companies involved in industries such as accounting, architecture, bookstores, campus housing, facilities management, finance, food services, and technology.

The exhibit hall featured the products and services of 178 companies involved in industries such as accounting, architecture, bookstores, campus housing, facilities management, finance, food services, and technology.