Endowments create vital support for higher education. In a 2014 white paper, Understanding College and University Endowments, the American Council on Education characterizes this special role: “An endowment links past, current, and future generations. It allows an institution to make commitments far into the future, knowing that resources to meet those commitments will continue to be available.”

Endowments of U.S. colleges and universities collectively manage over a half trillion dollars, and each year roughly 4 to 5 percent of that aggregate is spent by the educational institutions. Despite the collective importance for higher education, the aggregate figures mask vastly different institutional profiles. For example, the 2016 NACUBO-Commonfund Study of Endowments (NCSE) reveals an average endowment at American universities of $639.9 million, but more than half the institutions reported holding less than $116 million, while 20 have endowments in excess of $5 billion.

Higher returns on investment strengthen any endowment’s ability to provide sustained support, but what are the keys to investment success? This article studies the links between and among the ways endowments are governed; how capital is allocated across different types of assets (e.g., stocks, bonds, private equity, and hedge funds); and, ultimately, how endowment investments perform. We pay particular attention to the structure and expertise of endowment investment committees. Specifically, we ask, “What factors influence the allocation of assets?” and “What factors promote better investment performance?”

The following narrative (1) highlights several prominent patterns in endowment returns and allocations; (2) outlines the various features of endowment governance, with special emphasis on investment committees; (3) examines the investment experience and expertise of the individuals who serve on investment committees; and (4) discusses several findings regarding the ways that investment committee characteristics and expertise are linked to asset allocation and investment performance.

Endowment Returns and Allocations

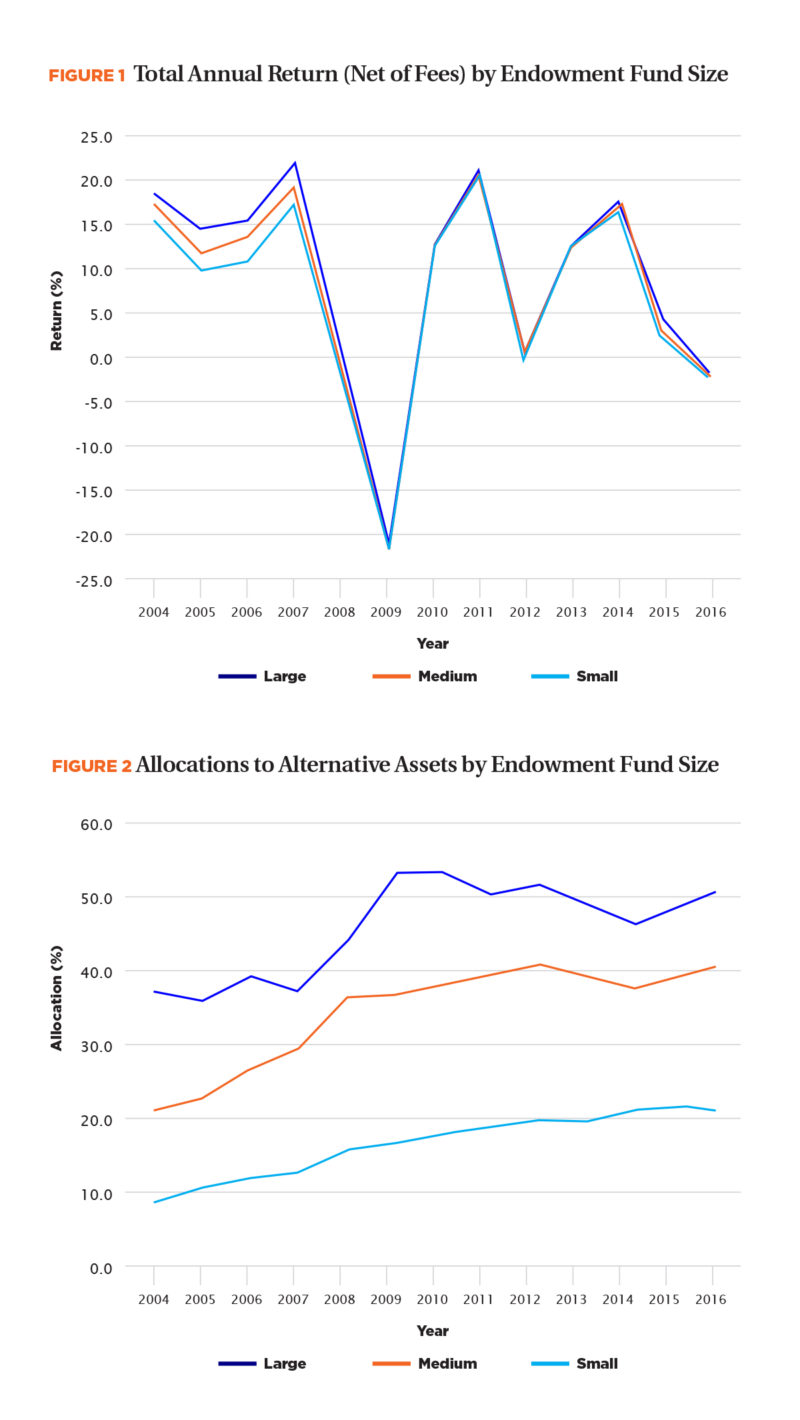

Endowments make headlines each year, as colleges and universities report their investment returns. Figure 1 provides average rates of return (net of fees) across all the endowments in the NCSE annual surveys, partitioned by endowment size: large funds (more than $1 billion in assets); medium funds $250 million to $1 billion); and small funds (below $250 million). Results cover 670 colleges and universities that reported their endowments in 2004, with the number increasing steadily after 2008, reaching 792 in 2016. Not surprisingly, endowments were not immune to the rise and fall of financial markets during the recent decade.

Previous research on endowment returns has endeavored to explain the differences in portfolio allocations and realized returns across endowments. For example, J. Lerner, A. Schoar, and J. Wang document (in their 2008 article “Secrets of the Academy: The Drivers of University Endowment Success,” in the Journal of Economic Perspectives) the degree to which large endowments shifted their asset allocation toward alternative investments, such as hedge funds, private equity, and venture capital, prior to the financial crisis. The result (at least at the time of that research) was that these large endowments had enjoyed superior returns as the result of their altered portfolio compositions.

However, the authors caution against a simple mimicking strategy, arguing that access to high performing funds may in fact be the secret to success in the alternative space. Indeed, this “endowment model” (frequently linked to Yale University, and then Chief Investment Officer David F. Swenson, who authored Pioneering Portfolio Management [Free Press, 2009]) is often mentioned as a key driver behind the gap between select large institutions, that can access high performing alternative asset funds, and smaller funds that cannot.

Figure 2 illustrates the magnitude of the shift towards alternative assets, again using NCSE data and partitioned by asset size. Figure 2 shows that large endowments have, on average, invested half of their assets in alternatives in 2016. Smaller endowments steadily increased their allocations to alternatives from 2004 to 2016, but still fall far short of those allocations made by larger institutions.

The flip side of the rise in alternatives is a reduction in allocations to equity and fixed income securities. By 2016, large endowments held, on average, less than one-fifth of their portfolios in U.S. publicly traded stocks. While the large endowments control the vast majority of assets, small endowments dominate by number. For instance, our method for partitioning funds leads to almost three-fourths of the NCSE funds being classified as small, whereas slightly less than 10 percent is characterized as large.

Analyzing the Variables

Using the NCSE data for their article “Do (Some) Universities Earn Alpha? (Financial Analyst Journal, 2013), B. Barber and G. Wang find that the variation over time of average endowment returns is explained almost completely by changes in indices for public stocks and bonds. Moreover, they conclude that the average endowment return matches, but does not exceed, the return from passive investing in a blend of stock and bond indices.

The authors do find, however, significant and persistent differences in performance across endowments. Ivy League and other schools, whose students have top SAT scores, earn returns well above those of the average endowment. The authors conclude that this outperformance stems from higher allocations to alternative assets and not because these elite schools can pick better than average performers within the alternative asset classes. In other words, the findings suggest that outperformance in overall endowment returns is due to decisions about asset allocation (i.e., investing in alternatives), not manager selection (i.e., picking high performers relative to other alternatives) or market timing (i.e., temporary movements in and out of asset classes).

Distinguishing between asset allocation and selecting high performing managers within an asset class for alternative assets faces many challenges.

Some would argue that the distinction is itself problematic because investable indices for these asset groups are generally not available. For example, an investor cannot make a passive investment in an index of private equity funds. Instead, proxies for average returns in the asset class are used.

Alternative asset vehicles, such as hedge and private equity funds, have much shorter histories than do vehicles that provide access to public stocks and bonds. For instance, unlike earlier private equity funds, recent research—“How Do Private Equity Investments Perform Compared to Public Equity?” (Journal of Investment Management, Vol. 14, No. 3, 2016)—shows that private equity funds started since 2005 have not outperformed public stocks on average. In parallel, data from the NCSE for the past few years (shown in Figure 1) reveal that the gap between returns for large and small endowments has largely disappeared during the strong bull market in public equities.

Altogether, while there does appear to be significant temporal and cross-fund variation in both portfolio returns and the associated role for alternative assets, little is known about the role of fund governance in determining these outcomes.

Endowment Governance

As most business office staff know, governance covers the structure of and responsibilities for decisions about how an endowment invests and spends money.

Endowment governance often includes three levels: a board, an investment committee, and staff. The board specifies broad fund objectives, decides on spending from the endowment, and delegates certain responsibilities—generally appointing an investment committee (IC) to look after the specifics of the investment process. The committee sets the investment policy, risk limits, and target allocations for assets. In turn, committee members delegate powers to a management staff to implement policy.

Very large endowments typically have full-time chief investment officers (CIOs) and a dedicated staff to implement policy and make investments. Such staff is not economically prudent for small endowments, and the investment committee may itself be actively involved in selecting asset managers, often aided by a consultant or outside money manager.

In recent years, an array of firms that can serve as an outsourced CIO (OCIO) have evolved, offering an endowment ways to outsource all or parts of the implementation of investment policy. These firms have arisen in response to endowments’ challenges in dealing with the trade-offs between administrative costs, investment expertise, and investment performance. These trade-offs and costs are especially important with regard to alternative assets where investment structures, assets, and strategies can be quite complicated as compared to traditional investments in equities and fixed income.

Best practices of investment committees. In reviewing summaries of advice on what is perceived as best practice for investment committees (see reports by Cambridge Associates, Greenwich Roundtable, among others), some common themes emerge.

- A clear and concise investment policy statement provides the purpose and objectives of the endowment.

- Effective committees are diverse in perspective but not too large to inhibit decision making.

- Investment committee structures include conflict of interest policies.

- A clear delineation of responsibility is necessary in terms of the way the committee members interact with staff.

- An effective investment committee focuses on governance rather than day-to-day investments.

Related data on governance. The NCSE provides information on some aspects of IC governance. Data include the number of voting members, the nature of conflict of interest policies, and information on endowment staff.

- Average committee size corresponds to the conventional wisdom mentioned earlier. The typical IC has seven to nine voting members, and this average has been fairly constant over the past decade. There is modest variation when endowments are segmented by size. Large endowments are at the upper end of the range (average of nine voting members in 2016) compared to averages for medium (8.6) and small (7.7) endowments. Interestingly, larger endowments have a higher proportion of voting members who are not trustees, and this accounts for their larger average committee. For large endowments, about 2.3 of the voting members are, on average, not trustees; whereas that figure is only 1.5 for medium endowments and 1.1 for small endowments. Apparently, larger endowments tap into non-trustee talent more often than do smaller endowments.

- The average sizes of investment committees mask some variation. For instance, one-tenth of large endow-ments have five or fewer voting members and another tenth have 14 or more voting members. Medium and smaller endowments exhibit similar variation. There is also variation in the inclusion of voting members who are not trustees. Even though investment committees of large endowments have, on average, 2.3 members who are not trustees, more than a quarter are composed entirely of trustees as voting members. For committees of both small and medium endowments, more than half are composed entirely of trustees as voting members.

- In line with fiduciary responsibilities, endowments typically have a conflict of interest policy in place. This is almost always the case at the board level and for senior staff. For instance, among small endowments, 97 percent report a policy at the board level and 86 percent for senior staff (supported by data from 2016). Survey data from 2016 on investment committees are somewhat more difficult to interpret since committee members can also be board members, and hence, subject to board policies. For instance, even though 99 percent of small endowments report a conflict of interest policy at the board level, only 63 percent note a policy for the IC. Many of the remaining 37 percent of small endowments may well have all IC members covered by board policies, since (as noted earlier) their voting members are typically trustees. Not surprisingly, since ICs for larger endowments tend to have more voting members who are not trustees, more than 80 percent of these committees report a conflict of interest policy at the IC level.

Investment Committee Expertise

Beyond the investment committee’s formal structure are the expertise and experience of its members. Such experience may be especially important, particularly in alternative asset classes, such as venture capital that are typically harder to access and evaluate than publicly traded securities. Committee members can shape appropriate allocation policies and interact with staff to help gain access to high-performing managers.

NCSE data, which report whether IC members are investment professionals and have backgrounds in alternative assets, show that a striking difference between large and small endowments is in the investment experience of investment committee members. ICs for large endowments have substantially more investment experience. More than three-fourths of IC members overseeing large endowments are investment professionals (on average, 7.0 of 9.0 voting members in 2016). In contrast, about one-third (2.6 out of 7.7 in 2016), of small endowment IC members have this background. Medium endowments fall somewhere in between, with 5.8 of 8.6 voting members classified as investment professionals. Thus, small endowments seem to have considerably less professional experience than their larger counterparts.

Differences in IC investment experience are even more pronounced when we focus on alternative assets. More than half (on average, 5.3 of nine, in 2016) of the voting members on investment committees of large endowments have professional experience in alternative assets. In contrast, for small endowments, the average number of members with expertise in alternatives is 1.4—less than half the figure for the typical large endowment. Medium-sized endowments again fall in between, with an average of 3.8 members with experience in alternatives.

We also examined whether IC size and member experience differed between endowment committees of private and public colleges and universities. We found little difference by the end of our sample period (2004–2015). Apparently, differences in IC size and expertise in these institutions relate more to the scale of the endowment than to whether a school is public or private.

We note, however, that over our sample period, public schools (unlike private institutions) experienced substantial growth in the number of IC members with investment experience, especially related to alternatives. For instance, by 2015 the average number of IC members with a background in alternative assets was 3.0 for both private and public institutions. In contrast, in 2006 the figure for private universities was double that of public universities.

Expertise’s Effect on Allocation and Returns

Is investment committee expertise linked to asset allocations? Figure 2 shows that large endowments have significantly higher allocations to alternative assets, and as described earlier, large endowments have ICs with more expertise in alternatives.

Not surprisingly, these parallel patterns are present in statistical tests. The correlation between the number of IC members who are alternative specialists and the endowments’ allocation to alternative strategies is 0.46. If the proportion of the committee (rather than number of specialists) is used, the correlation is 0.36. Thus, the investment committees that endorse higher allocations to alternatives have committee expertise in that arena.

Other correlations. To provide a stronger test of the links between expertise and asset allocation we use a regression framework and control for endowment size, the type of university (private or public), and the year. These controls allow us to isolate the degree to which expertise captures something not already explained by these other time-varying and fund-specific factors. After controlling for these factors, the results show a substantial and statistically significant link between expertise and allocations.

Our regression estimates indicate that (on average) the allocation to alternative investments increases by approximately 2 percent for each additional member with experience in alternatives. This allocation shift comes primarily from commensurate reductions in the allocations to domestic equity and fixed-income.

We also experimented with the construction of an endowment governance index, where we award higher scores to investment committees with better governance. Even controlling for fund governance measured in this way, the links between expertise and allocations remain very strong (and statistically significant). There is some evidence that stronger governance (a higher index level) leads to a larger allocation to alternatives, but the impact was much smaller than that for IC expertise. More research (and likely additional data) is needed to shed additional light on these governance effects, and the interaction between governance and committee expertise.

Overall linkages. Finally, we explored how expertise and governance are linked to overall endowment returns. Similar to the Barber and Wang 2013 study, we find that higher allocations to alternatives have led to higher endowment returns, even when we extend the data to the post-crisis period. Moreover, our evidence suggests that investment committee experience contributes to higher returns by getting the endowment into better-than-average funds. More alternatives experience on the investment committee appears to be linked to an endowment investing in better-than-average performers within alternative asset classes. This effect is substantial, on average, and holds when controlling for variation over time and the quality of governance. Our data do not allow us to disentangle the exact route by which this effect works. It may be due to contacts made available to staff that enable the endowment to invest in funds that have limited access, especially important in areas such as venture capital. It may contribute to information for manager selection among that funds that are not restricted. We suspect multiple channels are at work.

The level of expertise is most important for large funds, but still apparent for medium-sized funds. In contrast, the effect is not present for small funds. This may not be surprising since small endowments face many obstacles to investing in alternative assets. Often, minimum requirements for investment size make it impossible for a small endowment to participate in a fund. Moreover, using funds-of-funds to get access to a diversified set of alternative investments may involve an additional layer of fees.

In summary, our analysis indicates that there have been important trends in asset allocation for endowment funds of all sizes from 2004 to the present. The most important trend has been away from traditional “long-only” investments in public securities toward alternative investments of various types. This trend has coincided with a trend toward larger and more-experienced investment committees.

Importantly, our research reveals that substantial investment committee experience in alternatives seems to be linked to better performance in alternatives, not just to higher allocations in alternatives. These effects are strongest among large endowments.

Overall, these results suggest that, on average, endowment fund returns can benefit from having an investment committee that includes individuals with substantial expertise in alternative assets.

MATTEO BINFARÈ, GREG BROWN, and CHRISTIAN LUNDBLAD are at the Kenan-Flagler School of Business, at the University of North Carolina at Chapel Hill, where Binfarè is a doctoral student and Brown and Lundblad are professors; ROBERT S. HARRIS is a professor at the Darden Graduate School of Business Administration, at the University of Virginia, Charlottesville.